The recent developments in the Senate regarding Trump’s tax and budget bill have caused quite a stir in the electric vehicle (EV) industry. The $7,500 tax credit for electric vehicles is now on the chopping block, with plans to eliminate it by the end of September. This move, part of the GOP’s budget and tax bill, has raised concerns about the future of EV adoption in the US.

It comes as no surprise that the fossil fuel industry seems to have a heavy influence on these decisions, especially considering reports that Trump received over $1 billion from the oil industry in exchange for ending incentives for electric cars. While this may have been expected, it seems that even Elon Musk, CEO of Tesla, was caught off guard by the Senate’s actions. Despite Trump and the GOP campaigning on this issue, it appears that the repercussions are now hitting home for Musk and his company.

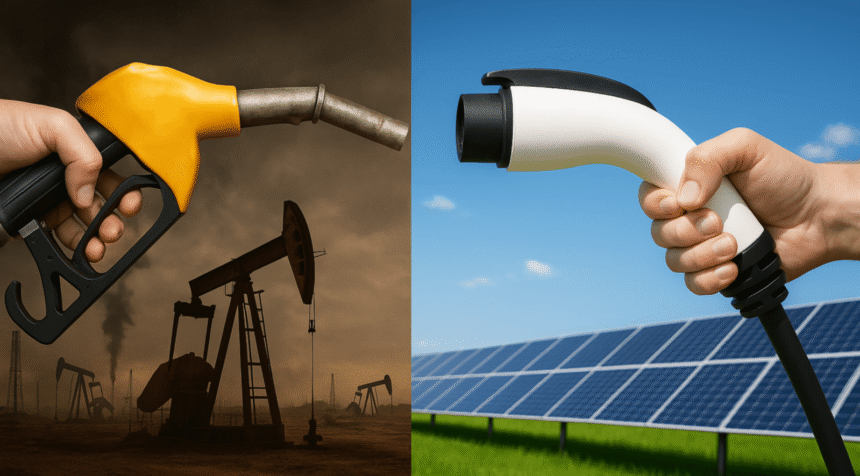

The Senate’s updated version of the bill not only eliminates the electric vehicle tax credit but also accelerates the phase-out of incentives for solar, wind, and energy storage projects. Additionally, there are provisions that impose additional taxes on projects using materials from China. These changes could have far-reaching consequences for the US’s transition to clean energy and electric vehicles.

As the US lags behind other countries in EV adoption, these new developments will only widen the gap and make the domestic auto industry less competitive globally. Ironically, Tesla, a key player in the EV market, stands to be the most affected by these changes. With Musk’s financial contributions to Trump and the GOP, Tesla is now facing potential financial losses as a result of the elimination of the tax credit.

Overall, these decisions by the Senate could have significant implications for the future of electric vehicles and renewable energy in the US. It remains to be seen how this will impact the industry and whether there will be any pushback from stakeholders in the EV and clean energy sectors.