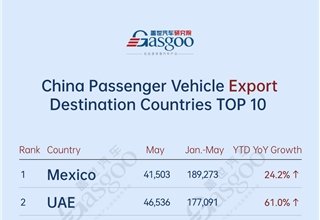

China’s passenger vehicle exports have seen significant growth and diversification in various international markets. From January to May 2025, the top 10 destination countries for China’s passenger vehicle exports include Mexico, UAE, Russia, Brazil, Belgium, UK, Australia, Saudi Arabia, Malaysia, and Spain.

In Mexico, exports reached 41,503 units in May and totaled 189,273 units from January to May, showing a 24.2% year-on-year increase. The UAE remained the top export market in the Middle East, with 177,091 units exported from January to May, marking a 61.0% year-on-year growth. However, exports to Russia dropped by 55.3% due to economic factors affecting consumer demand.

In Europe, countries like Belgium, UK, and Spain showed signs of recovery, with Belgium recording a 0.7% year-on-year growth in exports. The UK saw a 2.6% increase in exports, while Spain experienced a significant 50.3% growth in Chinese automakers’ market share.

The trend of regional diversification is evident in the new energy vehicle (NEV) exports from China. Mexico and Southeast Asia emerged as the fastest-growing export markets for NEVs, with China exporting 69,103 NEVs to Mexico from January to May 2025. In Southeast Asia, countries like Thailand and Indonesia are actively promoting NEV policies and incentives, leading to increased export volumes.

In Europe, Chinese automakers have gained traction, with SAIC PV and BYD Auto leading in passenger vehicle exports. BYD Auto recorded a remarkable 235.5% year-on-year growth in exports, solidifying its position in the European market. Other emerging players like eGT and Volkswagen Anhui also posted strong growth, showcasing the impact of China’s manufacturing scale and brand strength in Europe.

Chinese automakers have also expanded their presence in Southeast Asia, with BYD Auto leading in exports to the region. Traditional automakers like Changan Auto and SAIC PV faced challenges, while NEV brands like Tesla and XPENG gained momentum in Southeast Asia’s growing EV market.

In North America, BYD Auto led in passenger vehicle exports, with a 205.2% year-on-year growth. Chery Auto and GAC Trumpchi also saw significant export growth, highlighting the increasing influence of Chinese brands in the region.

In Central and South America, Chinese automakers showed divergent performance, with BYD Auto leading in exports despite a 24.2% year-on-year decline. Chery Auto and Great Wall Motor achieved notable growth, focusing on flexible product strategies and localization to meet market demand.

The Middle East market continued to grow rapidly, with Chery Auto maintaining its top position in exports. Geely Auto and BYD Auto also saw export growth, driven by advanced NEV technology and strong brand appeal in the region.

Oceania sustained strong demand for Chinese vehicles, with Chery Auto and BYD Auto leading in exports. Leapmotor emerged as a breakout performer with a significant year-on-year growth, showcasing the potential for Chinese brands in the region.

Overall, Chinese automakers have shown resilience and adaptability in navigating diverse international markets, leveraging regional policies and market trends to drive export growth and brand recognition globally.