Nio Achieves Record Vehicle Deliveries in Third Quarter, Set to Release Financial Results

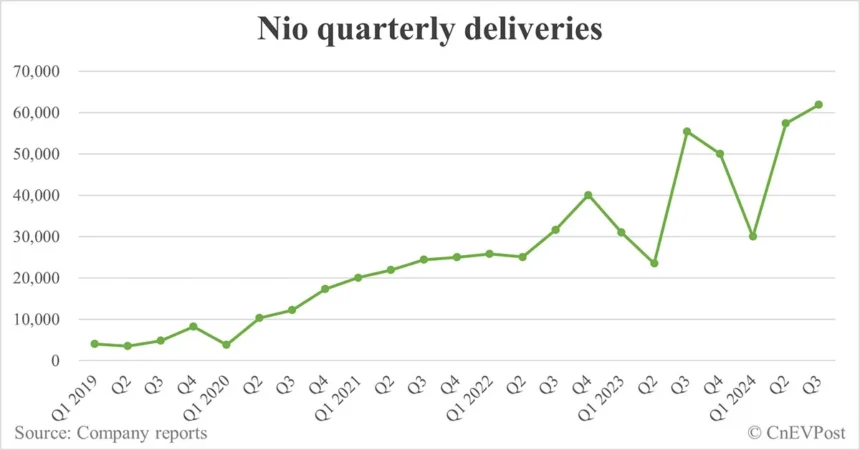

Nio, the Chinese electric vehicle (EV) maker, has announced that it delivered a record 61,855 vehicles in the third quarter of 2024. This figure falls within the company’s guidance range of 61,000 to 63,000 vehicles. The deliveries for the quarter saw an 11.59 percent year-on-year increase and a 7.81 percent increase from the previous quarter.

The company is set to release its unaudited financial results for the third quarter on Wednesday, November 20, before the US markets open. An earnings call will follow at 7:00 am US Eastern time (8:00 pm Beijing time) on the same day.

In the second quarter of 2024, Nio reported a net loss of RMB 5.05 billion, a decrease of 16.7 percent year-on-year. The company’s gross margin for the quarter was 9.7 percent, the highest since the third quarter of 2022. Additionally, the vehicle margin reached 12.2 percent, demonstrating significant improvement.

Analysts predict that Nio’s net loss in the third quarter will decrease by 5 percent sequentially to RMB 4.9 billion, thanks to an anticipated improvement in gross margin. The company’s management has guided for further sequential growth in automotive gross margin in the second half of 2024, with a target vehicle margin of 15 percent for the Nio brand in the fourth quarter.

Looking ahead, Nio aims to achieve monthly sales of 30,000 to 40,000 units under the Nio brand, with a vehicle margin target of 25 percent in the long term. The Onvo brand is expected to have higher monthly sales than the Nio brand, with a target vehicle margin of 15 percent.

Investors and stakeholders can access a live and archived webcast of Nio’s third quarter earnings conference call on the company’s investor relations website. A replay of the conference call will also be available by phone until November 27, 2024, for participants who wish to listen to the discussion.

Overall, Nio’s strong performance in vehicle deliveries and margin improvement signals positive momentum for the company’s growth and financial outlook.