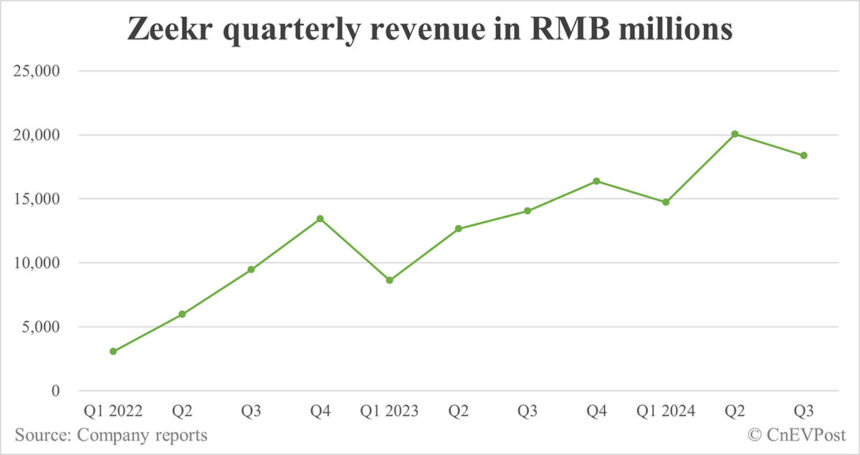

Zeekr, a prominent Chinese electric vehicle (EV) maker, recently announced its third-quarter financial results, revealing a significant decrease in net loss despite a slight decline in revenue. The company reported revenue of RMB 18.36 billion ($2.62 billion) for the third quarter, missing analysts’ estimates but showing a 30.71 percent increase from the same period last year.

Vehicle deliveries remained steady, with Zeekr delivering a record 55,003 vehicles in the third quarter. This marked a 51.13 percent increase year-on-year and a marginal 0.35 percent increase from the previous quarter. The company attributed the revenue growth to higher new product deliveries, the launch of the new Zeekr 7X model, and increased average selling prices due to changes in product mix.

However, revenue from sales of batteries and components saw a decline, totaling RMB 3.25 billion in the third quarter. The decrease was mainly due to lower battery pack sales in the domestic market. Despite this, Zeekr managed to narrow its net loss to RMB 1.14 billion, representing a 37.02 percent decrease from the previous quarter.

The company reported a gross margin of 16.0 percent, surpassing analysts’ expectations. The sequential decline in gross margin was attributed to lower margins on batteries and components. Vehicle margin stood at 15.7 percent, with lower average selling prices offset by savings from reduced auto parts and materials costs.

Research and development expenses for the third quarter totaled RMB 1.97 billion, showing a decrease from the previous quarter. As of September 30, 2024, Zeekr had cash and cash equivalents of RMB 8.3 billion. The company did not provide guidance for deliveries or revenue in the next quarter.

In other news, reports suggest that Geely plans to integrate Lynk & Co into the Zeekr brand. This move could further strengthen Zeekr’s position in the EV market and enhance its product offerings.

Overall, Zeekr’s third-quarter performance reflects a resilient approach to navigating challenges in the EV industry. With a focus on innovation, product development, and cost management, the company remains poised for future growth and success.