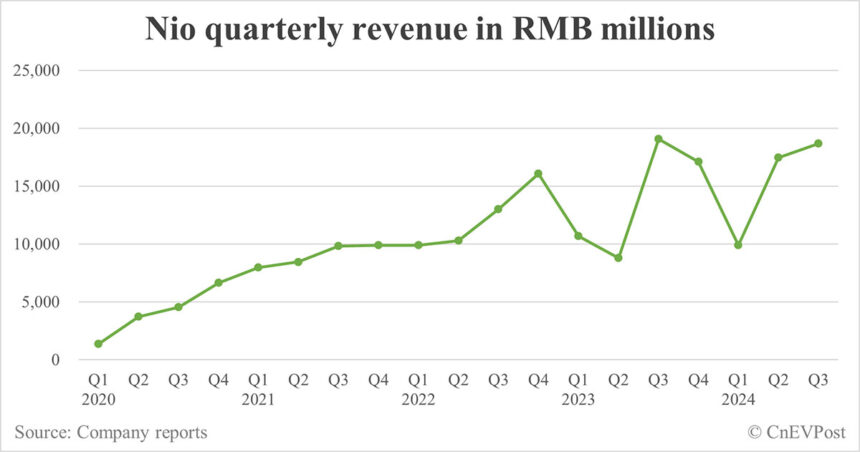

Nio, a leading Chinese electric vehicle (EV) maker, recently released its third-quarter financial results, which showed weaker-than-expected revenue but an improvement in gross margin and positive free cash flow. The company reported revenue of RMB 18.67 billion ($2.66 billion) for the third quarter, which was slightly lower than analysts’ expectations and below its own guidance range.

Despite the lower revenue, Nio delivered a record 61,855 vehicles in the third quarter, within its guidance range. The company also provided guidance for the fourth quarter, expecting to deliver between 72,000 to 75,000 vehicles, representing significant year-on-year growth.

Nio’s third-quarter gross margin improved to 10.7 percent, the highest since the third quarter of 2022. This increase was primarily driven by higher vehicle margin and sales of parts, accessories, and after-sales services with higher margins. The company’s vehicle margin for the quarter was 13.1 percent, showing a positive trend in profitability.

The company’s net loss for the third quarter was RMB 5.06 billion, slightly higher than the previous quarter but within expectations. Nio also reported an increase in research and development expenses, reflecting its commitment to innovation and product development.

As of September 30, 2024, Nio’s balance of cash and cash equivalents stood at RMB 42.2 billion, providing a solid financial foundation for future growth. The company remains optimistic about its global expansion plans, aiming to enter up to 25 countries and regions by 2025.

Overall, Nio’s third-quarter results demonstrate steady progress in key financial metrics and a positive outlook for the future. With a focus on product innovation, cost optimization, and expanding its global presence, Nio is well-positioned to capitalize on the growing demand for electric vehicles in the market.