BYD and Tsingshan are withdrawing from their plans to build lithium cathode plants in Chile due to plummeting lithium prices, as reported by Reuters. This decision comes after a prolonged drop in lithium prices, forcing BYD to rethink its investments in Chile, the world’s second-largest lithium producer.

According to the report, BYD and Chinese metals group Tsingshan had originally planned multimillion-dollar projects to build lithium cathode plants in Chile. However, both companies have now decided to back out of these plans. BYD filed an intent to withdraw its plans in January, while Tsingshan announced that it would not proceed with a $233 million project to produce 120,000 tons of lithium iron phosphate (LFP) per year.

Chile’s economic development agency Corfo cited plummeting lithium prices as the main reason for the projects being scrapped. The agency had previously offered preferential lithium prices to BYD and Tsingshan in an effort to attract investment to Chile. However, global market conditions, including a sharp drop in lithium prices, have impacted the companies’ investment decisions.

BYD had previously announced plans for a $290 million plant in Chile, which was expected to produce 50,000 tons of LFP for cathode materials annually. The company had also been awarded a lithium mining contract in Chile in January 2022 and preferential prices for lithium carbonate in April 2023. However, the decline in lithium prices has led to delays in these projects.

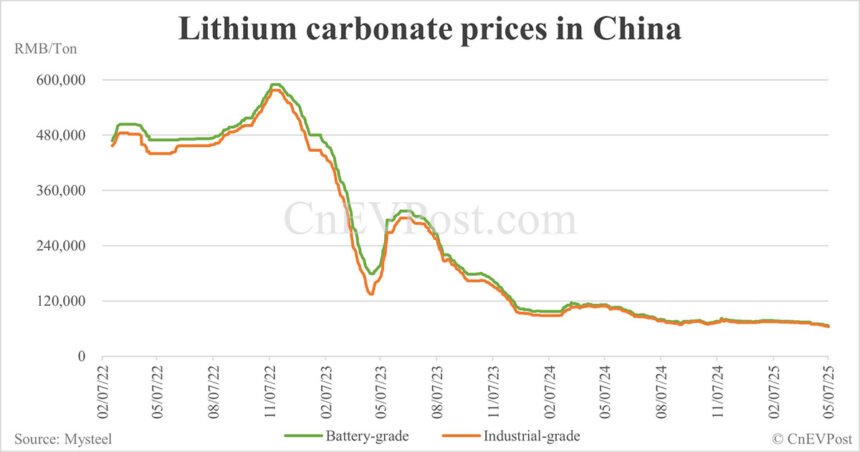

Lithium prices in China saw a significant increase three years ago due to the rapid growth of the electric vehicle (EV) industry. However, prices have since declined, with battery-grade lithium carbonate now priced below previous levels. This decline has impacted the production of LFP, which relies on lithium carbonate and iron phosphate as raw materials.

Despite these setbacks, BYD remains actively involved in the lithium industry. The company acquired mining rights for two plots of land in a lithium-rich part of Brazil in 2023, as reported by Reuters. This move indicates BYD’s continued interest in securing access to lithium resources for its future projects.

In conclusion, the decision by BYD and Tsingshan to withdraw from their plans in Chile highlights the challenges facing the lithium industry. While lithium prices have fluctuated in recent years, companies like BYD remain committed to securing access to essential resources for their operations.