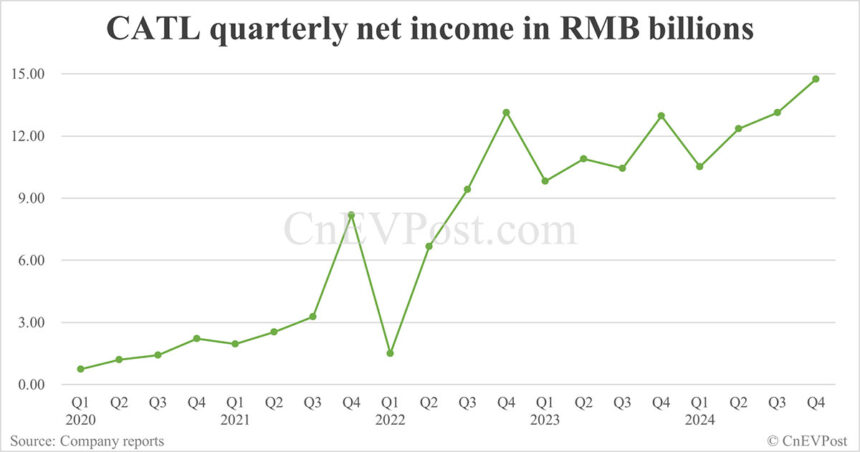

CATL, a leading Chinese power battery giant, recently reported its financial results for the fourth quarter of 2024. Despite a decrease in revenue of 3.08 percent year-on-year, the company saw record net income of RMB 14.74 billion, a 13.62 percent increase from the previous year.

The decline in revenue was attributed to lower product prices resulting from decreased raw material costs, such as lithium carbonate. Despite this, CATL experienced a significant increase in battery installations, with 88.31 GWh of electric vehicle (EV) batteries installed in the fourth quarter, marking a 52.79 percent year-on-year growth.

Operating costs for the quarter decreased by 22.34 percent compared to the previous year, contributing to a gross margin of 15.04 percent. This margin, while up from the same period in 2023, fell by 16.13 percentage points from the third quarter of 2024.

For the full year of 2024, CATL recorded 246.01 GWh of EV battery installations, representing a 47.21 percent increase from the previous year. The company’s net income for the year totaled RMB 50.75 billion, a 15.01 percent year-on-year increase, despite a 9.70 percent decline in annual revenue.

CATL’s revenue was distributed across various business segments, with power battery systems generating 69.90 percent of total revenue, energy storage battery systems contributing 15.83 percent, and battery materials and recycling accounting for 7.93 percent.

In terms of regional revenue distribution, CATL saw an increase in revenue from China, which accounted for 69.52 percent of total revenue in 2024. Revenue from overseas markets decreased to 30.48 percent, down from 32.67 percent in 2023.

Overall, CATL’s financial performance in 2024 showcased resilience in the face of challenges posed by fluctuating raw material prices. The company’s focus on innovation and growth in battery installations position it as a key player in the evolving EV market landscape.