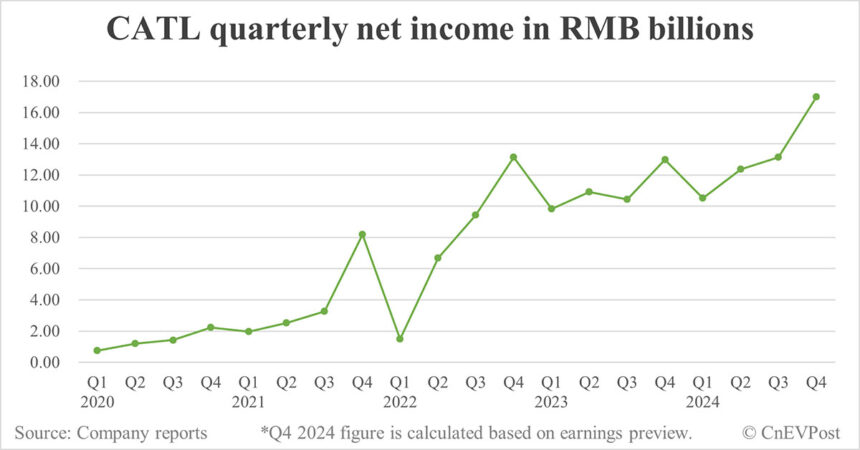

CATL (SHE: 300750) is projected to achieve a record net income of RMB 17 billion in the fourth quarter of 2024, marking a 31.01 percent increase year-on-year and a 29.41 percent jump from the third quarter. This growth is a testament to the company’s robust performance and strategic initiatives.

Looking ahead to 2024, CATL anticipates a decline in revenue ranging from 11.20 percent to 8.71 percent due to price adjustments in alignment with the decrease in raw material costs. Despite this anticipated dip in revenues, CATL remains optimistic about its overall financial outlook for the year.

The battery manufacturer expects its net income for the full year 2024 to fall between RMB 49 billion and RMB 53 billion, reflecting a substantial increase of 11.06 percent to 20.12 percent compared to 2023. After factoring in non-recurring gains and losses, CATL is forecasting a net income of RMB 44 billion to RMB 47 billion for 2024, representing a growth of 9.75 percent to 17.23 percent from the previous year.

CATL attributes its impressive financial performance to ongoing investments in technological research and development, which have bolstered its product competitiveness and market position. The company’s focus on innovation, coupled with strategic partnerships with customers, has driven solid growth across various markets and applications.

Despite a decline in revenue due to lower product prices influenced by raw material costs like lithium carbonate, CATL remains confident in its ability to navigate market challenges and maintain a strong financial position. The company’s proactive approach to product development and market expansion continues to fuel its success and resilience in the industry.

In the fourth quarter of 2024, CATL is expected to achieve a revenue of up to RMB 107 billion, remaining relatively stable compared to the same period in 2023 and showing a significant increase of 15.91 percent from the third quarter of 2024. The company’s electric vehicle (EV) battery installed capacity in the fourth quarter saw a substantial rise, reaching 88.31 GWh, up 52.79 percent year-on-year and 37.15 percent from the previous quarter.

For the entire year of 2024, CATL recorded 246.01 EV battery installations, marking a 47.21 percent increase from 2023. These figures underscore the company’s strong performance and continued leadership in the EV battery market.

In conclusion, CATL’s impressive financial results and growth projections highlight its resilience, innovation, and strategic vision in the dynamic battery industry. As the company continues to drive technological advancements and expand its market presence, it is poised for sustained success and market leadership in the years to come.