BYD’s share in China’s electric vehicle (EV) battery market saw a significant increase in February as its NEV sales rebounded, while CATL experienced a slight decline in its market share. According to data released by the China Automotive Battery Innovation Alliance (CABIA), China’s power battery installations reached 34.9 GWh in February, a 94.1 percent year-on-year increase but a 10.1 percent decrease from January.

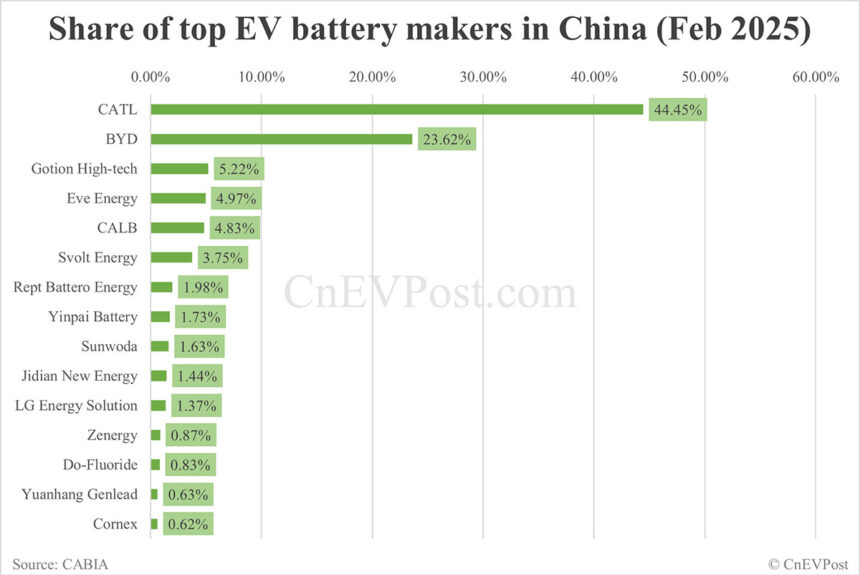

CATL continued to lead the market by installing 15.43 GWh of power batteries in February, holding a 44.45 percent share, although this was a 2.63 percentage point drop from January. BYD secured the second position with 8.20 GWh of power battery installations and a 23.62 percent share, marking a 0.72 percentage point increase from the previous month.

The fluctuations in BYD’s battery installations were closely tied to its NEV sales performance. The company sold an impressive 322,846 NEVs in February, a 163.95 percent jump from the same period last year and a 7.42 percent increase from January. Gotion High-tech followed BYD with an installed base of 1.81 GWh and a 5.22 percent share, while Eve Energy and CALB ranked fourth and fifth, respectively.

In terms of battery technology, China’s Li-ion ternary battery installations totaled 6.4 GWh in February, accounting for 18.5 percent of the total volume. LFP batteries, on the other hand, dominated the market with 28.4 GWh of installations, representing 81.5 percent of the total volume.

CATL, CALB, and LG Energy Solution were the top three players in the ternary battery segment in February. CATL also led the LFP battery market alongside BYD and Gotion, showcasing their dominance in this space.

Overall, China produced 100.3 GWh of power batteries and other batteries in February, with ternary and LFP battery production reaching 19.3 GWh and 80.9 GWh, respectively. The country also exported 12.8 GWh of power batteries, including both ternary and LFP variants.

The latest figures highlight the dynamic nature of the EV battery market in China, with key players like BYD and CATL vying for market share amidst changing consumer preferences and technological advancements. As the demand for NEVs continues to rise, it will be interesting to see how these companies adapt and innovate to stay ahead in this competitive landscape.