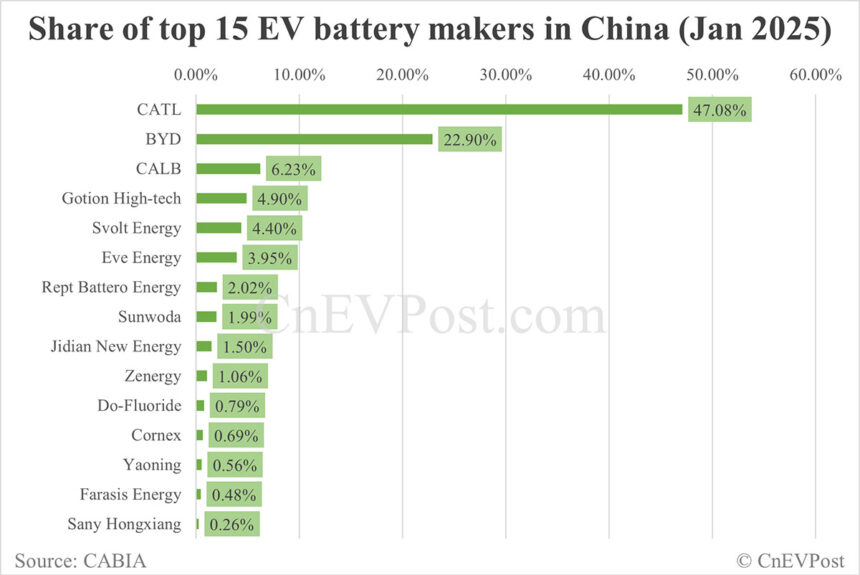

CATL (SHE: 300750) continues to dominate the Chinese electric vehicle (EV) battery market, with its share growing by 1.6 percentage points in January compared to December. On the other hand, BYD (HKG: 1211, OTCMKTS: BYDDY) saw a slight decrease in its market share by 0.29 percentage points due to lower NEV sales.

In January, China’s overall power battery installations reached 38.8 GWh, showing a 20.1 percent year-on-year increase but a significant 48.6 percent decrease from the previous month. This data was released by the China Automotive Battery Innovation Alliance (CABIA).

CATL installed 18.25 GWh of power batteries in January, securing the top spot with a 47.08 percent market share, which is a 1.6 percentage point increase from December. BYD followed with 8.88 GWh of installed capacity, holding a 22.90 percent share, a slight decrease of 0.29 percentage points.

The fluctuations in BYD’s battery installations were largely attributed to its NEV sales performance. In January, BYD sold 300,538 NEVs, marking a 49 percent year-on-year increase but a 42 percent drop from December, primarily due to seasonal factors.

CALB ranked third with 2.42 GWh of power batteries installed in January, capturing a 6.23 percent share, up by 0.66 percentage points from December. Gotion High-tech secured the fourth position with 1.9 GWh of installed capacity and a 4.9 percent market share.

In terms of battery composition, China’s lithium ternary battery installations amounted to 8.5 GWh in January, constituting 22.1 percent of the total, marking a 32.2 percent year-on-year decrease and a 40.4 percent decline from December.

The market was dominated by lithium iron phosphate (LFP) batteries, with an installed capacity of 30.2 GWh, representing 77.9 percent of the total, a 53.5 percent increase year-on-year, but a 50.5 percent decrease from December.

CATL, CALB, and Svolt Energy emerged as the top three players in terms of installed capacity of ternary batteries in January, with market shares of 73.98 percent, 12.79 percent, and 5.49 percent, respectively.

In the LFP battery segment, CATL, BYD, and Gotion led the market in installed capacity in January, capturing shares of 39.48 percent, 29.36 percent, and 6.04 percent, respectively.

China’s overall battery production in January reached 107.8 GWh, a 63.2 percent year-on-year increase but a 13.4 percent decrease from December.

The production of ternary batteries in January was 20.7 GWh, down 10 percent year-on-year and 20.4 percent from December, while LFP battery production reached 87 GWh, marking a 102.8 percent year-on-year increase but an 11.3 percent decrease from the previous month.

Furthermore, China exported 11.1 GWh of power batteries in January, including 6.8 GWh of ternary batteries and 4.3 GWh of LFP batteries.

The data indicates the ongoing dynamic nature of the Chinese EV battery market, with key players like CATL and BYD navigating changing market conditions to maintain their positions in the industry.