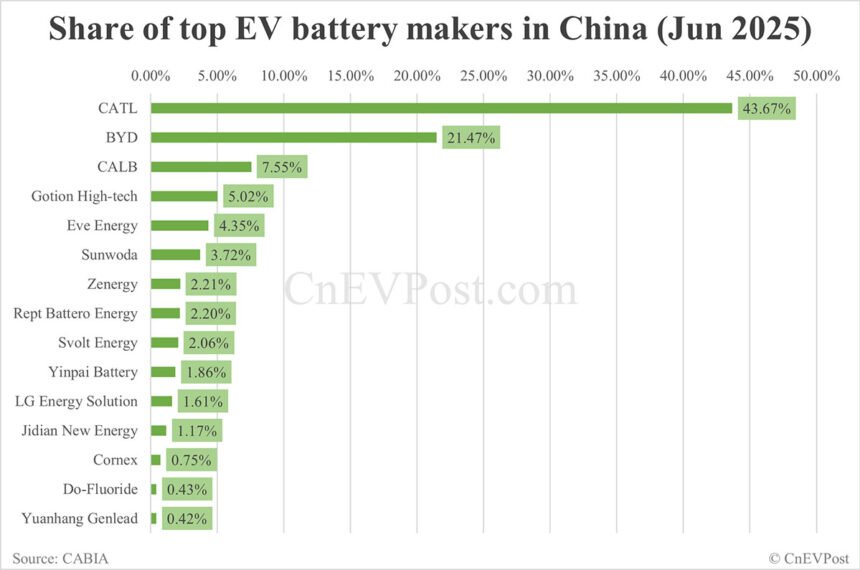

CATL (SHE: 300750) saw a notable increase in its market share in China’s electric vehicle (EV) battery market in June, according to data released by the China Automotive Battery Innovation Alliance (CABIA) on July 10. The company’s market share rose by 0.8 percentage points compared to May, reaching 43.67 percent. In contrast, BYD (HKG: 1211, OTCMKTS: BYDDY) experienced a decline of 1.02 percentage points, with its market share dropping to 21.47 percent.

Overall, China’s power battery installation volume in June reached 58.2 GWh, marking a 35.9 percent year-on-year increase and a 1.9 percent rise from the previous month. CATL led the market with battery installations totaling 25.41 GWh, while BYD ranked second with 12.49 GWh. CALB, Gotion High-tech, and Eve Energy followed closely behind in the rankings.

In terms of battery types, ternary lithium batteries accounted for 18.4 percent of the total installations in June, with a volume of 10.7 GWh. Despite a year-on-year decrease of 3.4 percent, ternary battery installations saw a 2.0 percent increase from May. Lithium iron phosphate (LFP) batteries dominated the market, making up 81.5 percent of the total volume with 47.4 GWh installed in June.

CATL, CALB, and LG Energy Solution were the top three players in ternary battery installations, while CATL, BYD, and CALB led the LFP battery market in June. China’s overall production of power batteries and other batteries in June reached 129.2 GWh, a 51.4 percent year-on-year increase and a 4.6 percent month-on-month rise.

The country also exported 15.8 GWh of power batteries in June, with ternary batteries accounting for 9 GWh and LFP batteries for 6.8 GWh. CATL and BYD’s combined EV battery installations from January to May accounted for 55.5 percent of the global total, highlighting the significant role these two companies play in the EV battery market.

Overall, the data for June reflects the dynamic nature of China’s EV battery market, with CATL continuing to strengthen its position while other players experience fluctuations in market share. The ongoing developments in battery technology and production indicate promising growth opportunities for the industry in the coming months.