China’s electric vehicle (EV) battery installations reached a new high in November, with a total of 67.2 GWh installed, representing a 49.7 percent increase year-on-year and a 13.5 percent increase from the previous month. This data was released by the China Automotive Battery Innovation Alliance (CABIA).

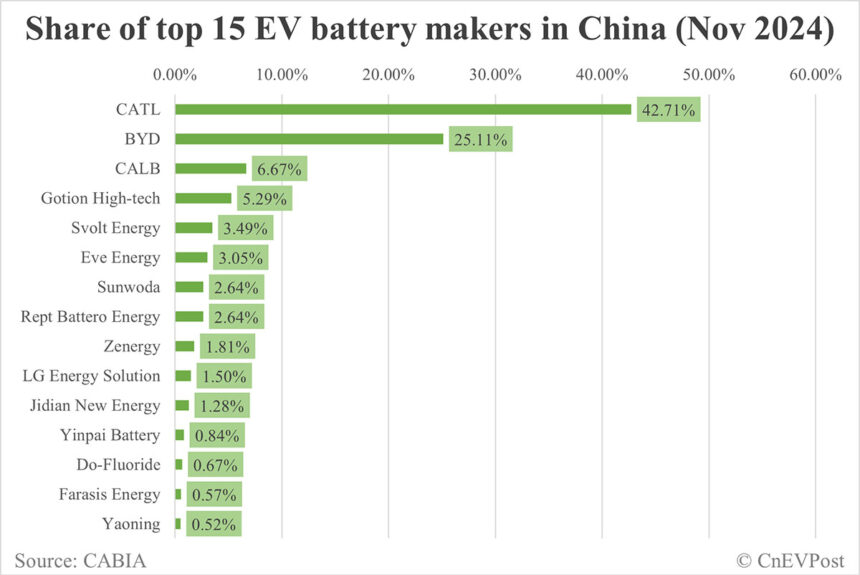

Leading the market in November was Contemporary Amperex Technology Co. Limited (CATL), which installed 28.7 GWh of power batteries, maintaining its top position with a market share of 42.71 percent. This was a slight decrease from the 42.78 percent share it held in October. Following closely behind was BYD, with 16.87 GWh of installed capacity and a market share of 25.11 percent. China Aviation Lithium Battery (CALB) came in third with a 6.67 percent market share and 4.48 GWh of installed power batteries, a slight increase from the previous month.

In terms of battery technology, China’s lithium ternary battery installations in November totaled 13.6 GWh, accounting for 20.2 percent of the total installations. This represented a 13.5 percent year-on-year decrease but an 11.6 percent increase from October. On the other hand, lithium iron phosphate (LFP) batteries dominated the market with 53.6 GWh of installed capacity, accounting for 79.7 percent of total installations. This marked an 84.0 percent year-on-year increase and a 14.0 percent increase from October.

CATL, CALB, and LG Energy Solution were the top three players in the ternary battery market in November, with market shares of 67.30 percent, 12.25 percent, and 7.39 percent, respectively. In the LFP battery market, CATL, BYD, and Gotion led the pack in terms of installed capacity, with market shares of 36.50 percent, 31.49 percent, and 6.28 percent, respectively.

Overall, China produced 117.8 GWh of power and other batteries in November, a 33.3 percent increase year-on-year and a 4.2 percent increase from October. Ternary batteries production reached 24.2 GWh, a 12.9 percent year-on-year decrease but a 3.3 percent increase from October. LFP batteries production, on the other hand, totaled 93.4 GWh, marking a 54.6 percent year-on-year increase and a 4.4 percent increase from October.

In terms of exports, China shipped out 12.5 GWh of power batteries in November, including 8.5 GWh of ternary batteries and 3.9 GWh of LFP batteries.

The EV battery market in China continues to show strong growth and competition among key players. With advancements in battery technology and increasing demand for electric vehicles, the industry is poised for further expansion in the coming months.