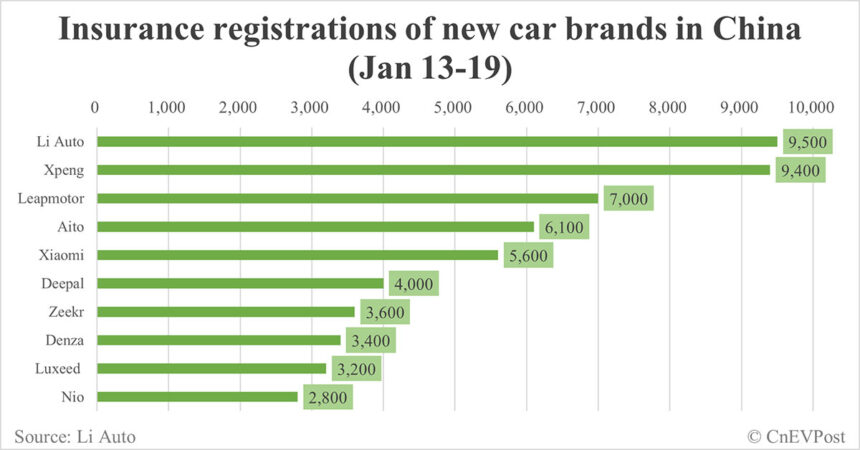

Major electric vehicle (EV) manufacturers in China experienced a resurgence in insurance registrations last week, despite the overall market slowdown as the Chinese New Year approaches. Nio, a leading EV brand, recorded 2,800 insurance registrations for its vehicles in China during the week of January 13-19, marking an 86.67 percent increase from the previous week. This growth is a positive sign for the company as it continues to expand its market presence.

On the other hand, Li Auto saw 9,500 insurance registrations last week, a 25.00 percent increase from the previous week. The company delivered a record 58,513 vehicles in December, although this fell slightly below its fourth-quarter delivery target range of 160,000 to 170,000 vehicles. Despite this, Li Auto remains optimistic about its future growth prospects, recently opening an R&D center in Munich, Germany.

Xpeng, another prominent EV manufacturer, reported 9,400 insurance registrations last week, up 27.03 percent from the previous week. The company delivered 36,695 vehicles in December, marking its fourth consecutive month of record deliveries. Xpeng’s success in the market is further highlighted by the strong performance of its new model, the Mona M03, which saw 15,904 units delivered in December.

Tesla, a global leader in the EV industry, recorded 10,000 insurance registrations in China last week, representing a 28.21 percent increase from the previous week. The company’s Shanghai factory, which produces the Model 3 sedan and Model Y crossover, continues to drive its growth in the region. Tesla recently launched the facelifted five-seat Model Y in China, showcasing its commitment to innovation and customer satisfaction.

BYD, a key player in the NEV market, saw 55,000 insurance registrations last week, up 28.50 percent from the previous week. The company achieved record sales of 514,809 NEVs in December, marking the seventh consecutive month of record sales. BYD’s strong performance underscores its position as a leading player in the industry, with plans to sell 5.52 million vehicles in 2025.

Xiaomi, a newcomer in the EV market, recorded 5,600 insurance registrations last week, up 3.70 percent from the previous week. The company aims to deliver 300,000 vehicles in 2025, following the successful launch of its first EV model, the SU7. Xiaomi’s partnership with Goldman Sachs has led to an upward revision of its EV sales forecast, highlighting the company’s growth potential in the coming years.

In conclusion, the EV market in China continues to witness dynamic growth and competition among key players. With a focus on innovation, sustainability, and customer satisfaction, these manufacturers are driving the transition towards a greener automotive future. As the industry evolves, it will be interesting to see how these companies adapt and thrive in an increasingly competitive landscape.