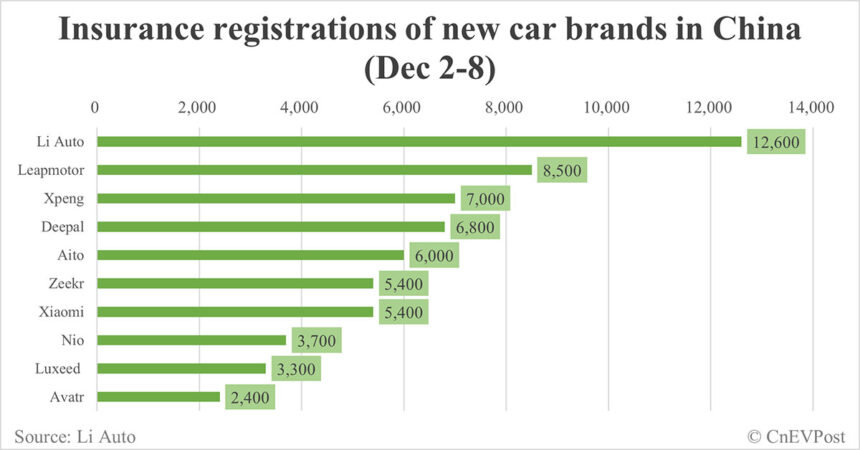

Electric vehicle (EV) brands in China experienced a drop in insurance registrations last week, reflecting a slower pace of vehicle deliveries at the beginning of the month. Nio, a prominent EV brand, saw 3,700 insurance registrations in China from December 1 to December 8, a 9.76 percent decrease from the previous week.

Li Auto, on the other hand, reported 12,600 insurance registrations, marking a 5.88 percent increase from the previous week. This was a positive trend for Li Auto, especially as other brands experienced declines in insurance registrations.

Xpeng recorded 7,000 insurance registrations, a 25.53 percent decrease from the week before. Despite the drop, Xpeng delivered 30,895 vehicles in November, surpassing the 30,000 mark for the first time and achieving record highs for the third consecutive month.

Tesla, with 21,900 insurance registrations in China last week, experienced a 17.11 percent increase from the previous week. The US electric vehicle maker sold 78,856 vehicles in November, including 5,366 exported units, marking its highest month of sales in China for the year.

BYD saw 85,000 insurance registrations last week, a 13.09 percent decrease from the previous week. The company delivered 506,804 new energy vehicles in November, surpassing the 500,000 mark for the second time and achieving record sales for the sixth consecutive month.

Xiaomi recorded 5,400 insurance registrations, a 14.29 percent decrease from the previous week. The company’s Xiaomi SU7 deliveries exceeded 20,000 units in November for the second consecutive month, showing a positive trend in sales.

Zeekr reported 5,400 insurance registrations, down 12.90 percent from the previous week. However, the company delivered 27,011 vehicles in November, achieving its third consecutive record month of sales.

Leapmotor had 8,500 insurance registrations last week, a 7.61 percent decrease from the previous week. The company delivered 40,169 vehicles in November, surpassing the 40,000 mark for the first time and achieving record highs for the sixth consecutive month.

Aito, a brand jointly created by Huawei and Seres Group, recorded 6,000 insurance registrations last week, a 22.08 percent decrease from the week before. Despite the drop, Aito remains confident in reaching its delivery target of over 130,000 units for the year.

Overall, the EV market in China is experiencing fluctuations in insurance registrations, reflecting the varying pace of vehicle deliveries for different brands. Despite these fluctuations, companies like Li Auto, Xpeng, Tesla, BYD, and Xiaomi continue to show positive trends in sales and deliveries, setting new records and achieving growth in the competitive EV market.