New order flow for the Nio brand is estimated to be around 19,000 units in October, according to Deutsche Bank. This number is consistent with the figures from September. However, the sub-brand Onvo is estimated to have a higher order flow of about 15,000 units in October.

Deutsche Bank shared their forecasts for China’s major electric vehicle (EV) makers ahead of their October sales figures release. Analyst Wang Bin’s team anticipates another record-breaking sales month for the major EV players.

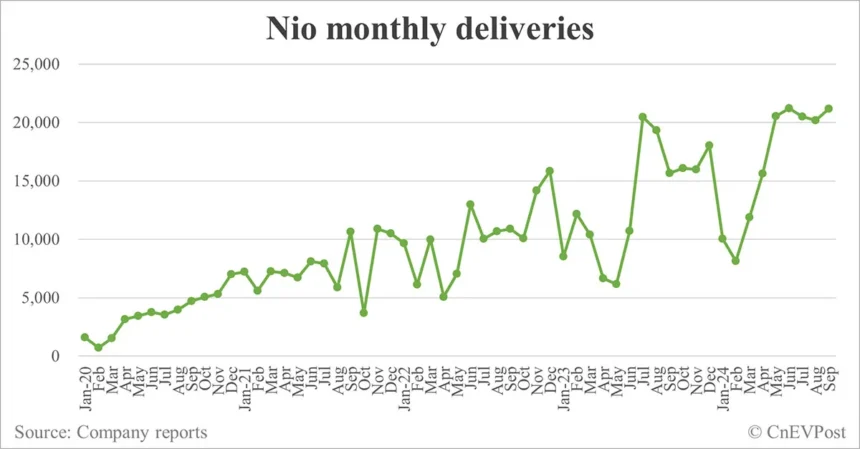

For Nio, the team predicts a delivery of approximately 24,500 units in October, marking the highest monthly delivery since the company’s inception. This represents a 53 percent year-on-year increase and a 16 percent sequential increase. In the first four weeks of October, Nio’s domestic retail sales reached 20,500 units.

The team also highlighted that the Onvo L60 SUV has been performing well, with deliveries expected to reach around 3,600 units in October. Nio plans to increase the monthly L60 production capacity from 5,000 units in October to 20,000 units by March 2025.

To maintain the new order flow for the Nio brand, the company has ramped up promotions in October, including an increase in accessory purchase bonus per vehicle.

On the other hand, Xpeng is expected to deliver about 23,000 vehicles in October, a 15 percent year-on-year increase. The team estimates that Xpeng Mona M03 sedan deliveries will be around 10,000 units, with other product deliveries totaling approximately 13,000 units. The Mona M03 has been a success, with a significant order backlog and wait times for certain versions.

Li Auto is projected to deliver about 55,000 units in October, a 36 percent year-on-year increase and a new monthly delivery high. Li Auto has introduced low-interest auto financing and other promotions to drive sales.

BYD’s wholesale volume is expected to reach about 520,000 units in October, a 72 percent year-on-year increase. The team estimates that BYD’s new order flow for October will be around 550,000 units.

Tesla’s deliveries in China are forecasted to be around 47,000 units in October, a 53 percent year-on-year increase. The company has extended its car-buying incentives in China to boost sales.

Zeekr is expected to deliver about 23,000 units in October, a 76 percent year-on-year increase. The team estimates that Zeekr’s new order flow in October will be around 22,000 units.

Leapmotor is projected to deliver about 36,500 units in October, a doubling year-on-year. Aito is anticipated to deliver about 35,000 units in October.

In conclusion, the EV market in China continues to show strong growth, with major players expected to achieve record sales figures in October. Each company is implementing various strategies to drive sales and maintain their competitive edge in the market.