Exploring the Future of Passenger Car Autonomous Driving: Seven Trends in NOA Development

In the ever-evolving landscape of autonomous driving technology, the path from L2 to L3 is becoming increasingly clear. The focus of the industry is shifting towards the widespread adoption of Highway NOA and the rapid advancement of Urban NOA. As we move into the second half of passenger car NOA development, key trends are emerging that are shaping the future of autonomous driving.

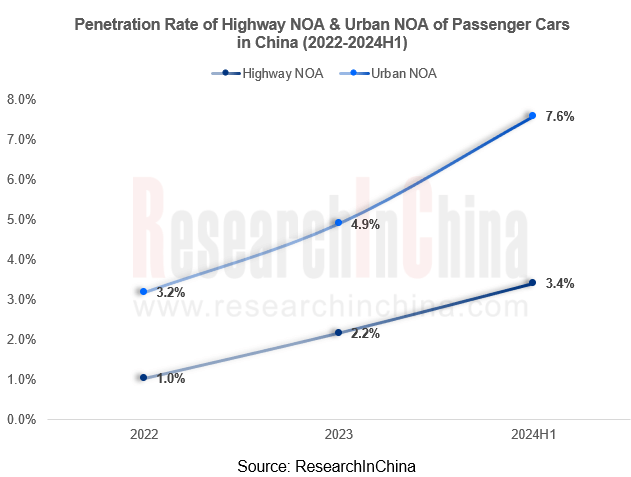

Trend 1: Increasing Penetration of Highway and Urban NOA

Since the introduction of Highway NOA by Tesla in China in 2019, the technology has seen rapid adoption, with a growing number of domestic and international brands incorporating it into their vehicles. By the end of 2023, the sales volume of domestic ADAS passenger cars with L2.5 and above reached 1.484 million, with a penetration rate of 7.1%. The penetration of Urban NOA is also on the rise, with sales volume reaching 732,000 units by 2024H1.

Trend 2: Urban NOA Arms Race

Leading OEMs such as Tesla, NIO, Xpeng Motors, and Huawei are driving the development of Urban NOA, with a focus on mass production of L2.9 models. The competition in the Urban NOA space has intensified, with many OEMs launching their own versions of the technology in 2023.

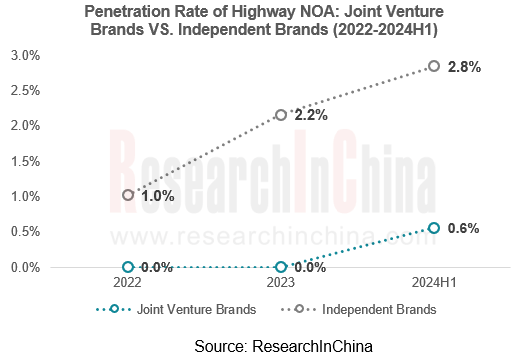

Trend 3: Joint Venture OEMs Embrace Highway NOA

Joint venture OEMs have started to accelerate their adoption of Highway NOA, with sales of Highway NOA models reaching 54,000 units by 2024H1. Independent OEMs are also seeing growth in this space, with sales volume increasing year-on-year.

Trend 4: Technological Equality in Mid- and Low-End Markets

Urban NOA technology is increasingly being adopted in mid-range vehicles, with the era of technological equality approaching. Models priced between 200,000-300,000 yuan are seeing the fastest growth in Urban NOA installations, making the technology more accessible to a wider range of consumers.

Trend 5: Map-Free Urban NOA Solutions

A shift towards map-free NOA solutions is gaining traction among Chinese OEMs, with companies like Li Auto, Xpeng Motors, and Huawei leading the way. These solutions eliminate the need for HD maps and offer a more flexible and adaptive driving experience.

Trend 6: End-to-End Foundation Models

Emerging OEMs are implementing end-to-end foundation models in their vehicles to enhance the capabilities of autonomous driving systems. These models leverage deep learning and real-time data processing to provide a safer and more reliable driving experience.

Trend 7: Vision-Only Perception Route

Chinese OEMs are exploring vision-only perception routes as a new direction in autonomous driving technology. By combining vision-based systems with map-free solutions and end-to-end models, these companies are paving the way for a more flexible and reliable autonomous driving experience.

As the industry continues to evolve, these trends will play a crucial role in shaping the future of passenger car autonomous driving. With advancements in technology and a growing focus on innovation, the era of fully autonomous vehicles is closer than ever before.