Analysts at JPMorgan have recently revised their sales estimates for BYD (HKG: 1211, OTCMKTS: BYDDY), predicting that the Chinese company is poised to become the “Toyota” of the global electric vehicle (EV) market. According to a research note released by Analyst Nick Lai’s team, BYD is expected to deliver 6.5 million units worldwide in 2026, surpassing their previous estimate of 6 million units reported in July of last year.

The team projects that BYD will achieve around 1.5 million units in overseas markets by 2026, maintaining their forecast from last July. This updated forecast indicates a significant increase in BYD’s market share, projecting a 7 percent share in the global light-duty vehicle market and a 22 percent share in the new energy vehicle (NEV) market by 2026.

The analysts view 2026 as a pivotal year for BYD’s global expansion strategy, as the company completes and scales up production at its four overseas manufacturing facilities in Thailand, Indonesia, Brazil, and Hungary. Despite the EU’s tariff adjustments, JPMorgan anticipates that BYD will focus on enhancing product offerings and configurations to compete in international markets rather than engaging in price wars.

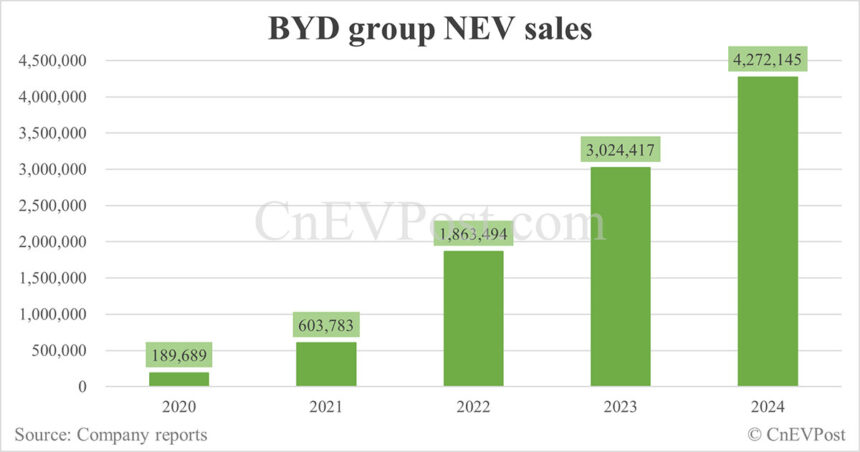

In 2024, BYD achieved substantial growth by selling 4.27 million NEVs, representing a 41 percent increase from the previous year. Of these sales, 4.25 million were passenger NEVs, while 21,775 were commercial NEVs. Additionally, BYD’s overseas NEV sales reached 417,204 units in 2024, marking a 71.86 percent growth from 2023.

Looking ahead, JPMorgan’s team forecasts that BYD’s sales will continue to climb in 2025, with an estimated 30 percent increase from 2024 to reach 5.5 million units. The projected rise in sales volume is expected to drive down unit costs, thereby strengthening unit margins for the company.

Despite the trend of price reductions among major EV manufacturers at the beginning of each year, BYD opted not to adjust prices in early 2025. This contrasts with Tesla’s move to kick off a price war by offering an insurance subsidy for the Model 3 at the start of the Chinese lunar New Year. Instead, BYD unveiled Smart Driving edition updates for 21 models without altering prices, a strategic decision that JPMorgan’s team interprets as a form of price marketing.

The analysts note that the delayed price war in 2025 was influenced by trade-in incentives and low inventory levels among OEMs in January. They underscore the significance of BYD’s strategic positioning and anticipate further growth and market expansion for the company in the coming years.