Chinese EV Brands Experience Mixed Results in Germany’s Auto Market

November proved to be a month of mixed outcomes for Chinese electric vehicle (EV) brands in the largest European auto market, Germany. MG saw a 33% decline, Xpeng was down by 19%, BYD experienced a 24% increase, and Nio surged by 93% in terms of registrations.

According to data from the German Federal Motor Authority, a total of 244,544 new passenger vehicles were registered in Germany in November, marking a slight decrease of 0.5% compared to the previous year. Notably, 14.4% of these registrations were for battery electric vehicles (BEVs), totaling 35,167 units, a significant 21.8% drop from the same period last year. On the other hand, plug-in hybrid vehicles (PHEVs) saw a 13.7% increase with 20,604 units registered.

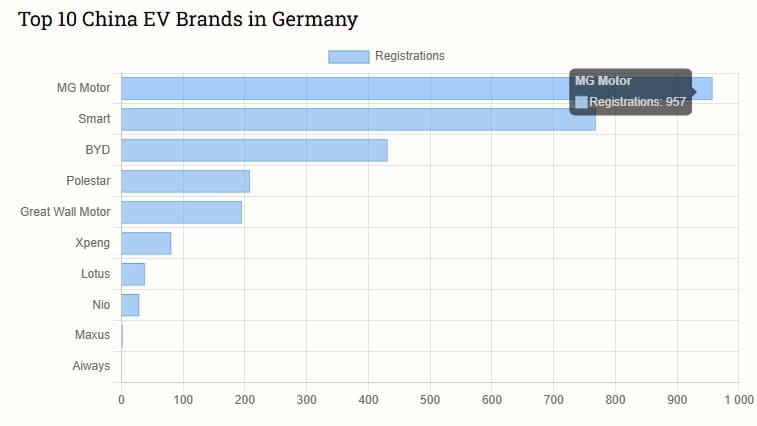

Chinese EV brands collectively registered 2,710 BEVs, capturing an 8% market share in the BEV segment, as reported by China EV DataTracker.

MG

SAIC-owned brand MG claimed the top spot with 957 EV registrations in November, despite experiencing a 33.2% decline from the previous month and a 42.8% drop year-over-year. In the period between January and November 2024, MG sold a total of 19,123 EVs in Germany. The brand faces a challenging import landscape with an additional 35.3% tariff on top of the existing 10% duty, resulting in a total tariff rate of 45.3%.

BYD

BYD registered 431 vehicles in November, marking a 24.2% increase from the previous month and a 23.1% rise year-over-year. From January to November 2024, BYD sold 2,568 EVs in Germany. The brand is subject to an additional 17% tariff, bringing the total import duty to 27%.

Nio

Nio, a Shanghai-based EV manufacturer, registered 29 vehicles in November, marking a significant 93.3% increase from the previous month despite a 42.0% decline year-over-year. In the period from January to November 2024, Nio registered 367 EVs in Germany, down 70% from the same period last year. Nio faces an additional 20.8% import tariff from the EU, resulting in a total tariff of 30.8%.

The European Commission recently increased tariffs on Chinese-made electric cars to 45.3% from 30 October, impacting the competitiveness of Chinese EV brands in the European market.

Overall, Chinese EV brands are navigating a complex regulatory environment in Germany, with varying tariff rates impacting their sales performance in the region. Despite facing challenges, these brands continue to make their mark in the competitive European auto market.