Chinese Passenger Car Exports: A Look at the Global Market

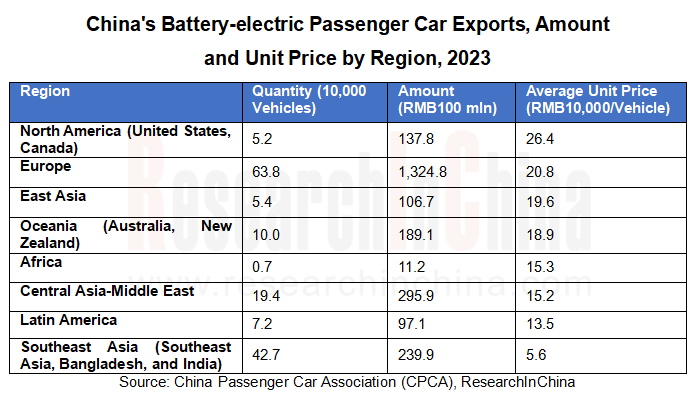

Passenger car exports: Europe is the largest export market of battery-electric vehicles, with the average export unit price 3.7 times that to Southeast Asia.

China’s automobile exports have seen a significant growth trend since 2022, with OEMs facing challenges in navigating the complex global market. As Chinese automakers expand their presence overseas, the next few years will be crucial for implementing effective strategies and closely monitoring market dynamics.

In August 2024, China exported 610,000 vehicles, marking a 39% year-on-year increase and a 10% month-on-month growth. From January to August, total vehicle exports reached 4.09 million, showing a 27% surge. The growth in China’s automobile exports can be attributed to the rising popularity of new energy vehicles globally and the competitive edge of Chinese automobiles, particularly in European and American markets.

Notably, passenger car exports accounted for 84.2% of total automobile exports from January to August 2024, with 42% being new energy vehicles. European countries like Belgium and the United Kingdom have emerged as key markets for Chinese new energy vehicles.

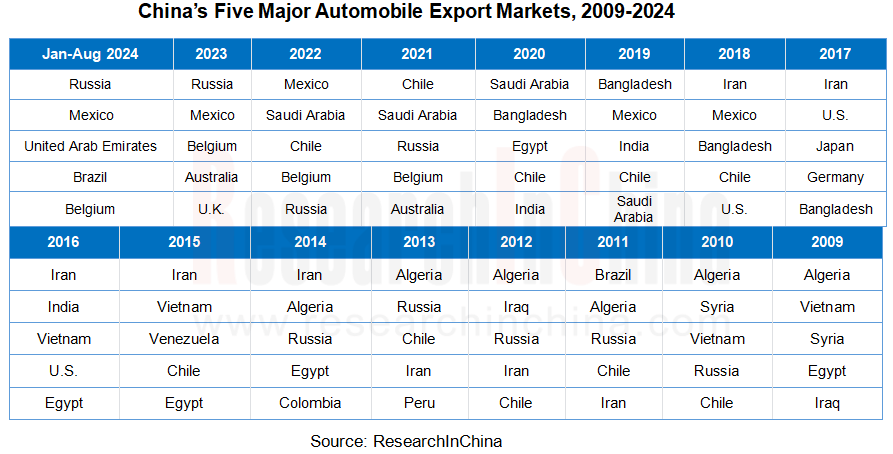

Examining the shifts in Chinese automobile export markets from 2009 to 2024 reveals significant changes:

- Pre-2016: Focus on Middle East, Southeast Asia, and Latin America.

- Post-2017: Shift towards economically developed countries like Belgium, Australia, Saudi Arabia, and the United Kingdom. This period also marked the inclusion of new energy vehicles in export statistics.

- Post-2019: Decline in exports to the United States due to trade tensions and tariff hikes.

The growth of new energy vehicle exports has propelled Chinese automakers into a phase of comprehensive upgrading, transitioning from product exports to technology, service, and brand exports.

Focus on European Market for Battery-Electric Vehicles

Europe has emerged as the largest export market for Chinese battery-electric vehicles. In 2023, China exported 640,000 such vehicles to Europe, valued at RMB132.5 billion. The average unit price to Europe was RMB208,000, significantly higher than the price to Southeast Asia at RMB56,000. This shift towards European markets signifies a qualitative change in Chinese automakers’ global strategy.

Despite challenges such as countervailing investigations and market access barriers, the robust foundation of China’s automotive industry, advanced technology, and skilled workforce continue to drive the growth of automobile exports.

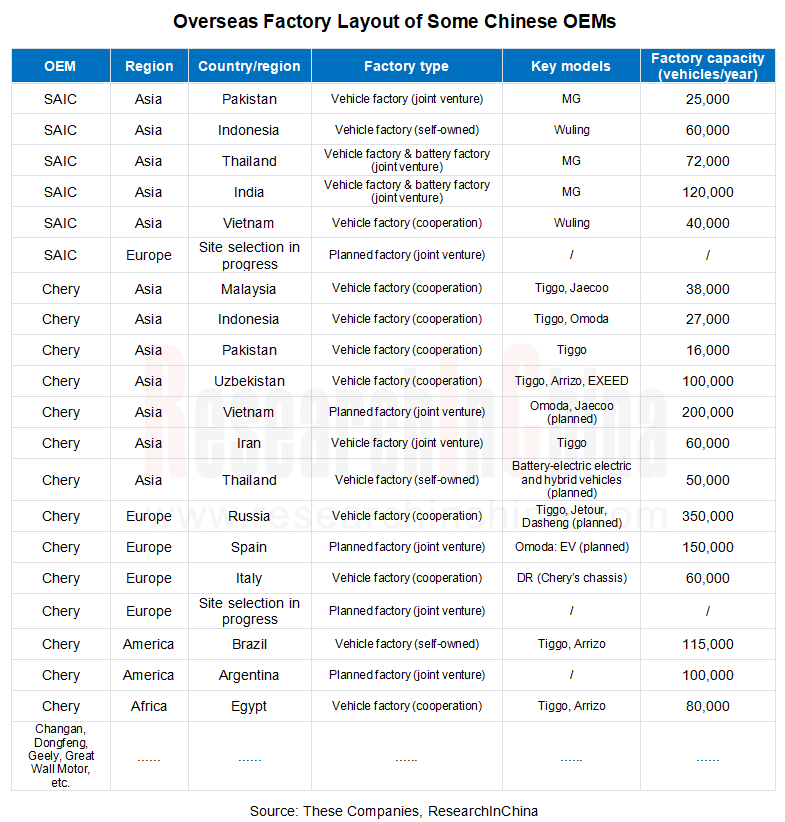

Expansion of OEMs Overseas

Chinese OEMs are not just exporting vehicles but also establishing comprehensive after-sales service networks overseas.

SAIC has set up European parts centers in the Netherlands and France to enhance after-sales services. With over 2,800 global marketing and service outlets, MG, a brand under SAIC, has a strong presence in Europe.

BYD recently acquired Hedin Electric Mobility GmbH in Germany to streamline its distribution activities. This move signifies a shift towards direct engagement with local dealers.

NIO has launched the NIO Power Europe Plant in Hungary, focusing on battery swap services for electric vehicles and R&D initiatives.

Several OEMs have also ventured into collaborative projects with global partners to drive technological advancements. SAIC’s collaboration with Audi and Stellantis’ investment in Leapmotor are notable examples of this trend.

Chinese OEMs are strategically establishing overseas factories in regions like Southeast Asia and Latin America, with a more cautious approach towards European and American markets.

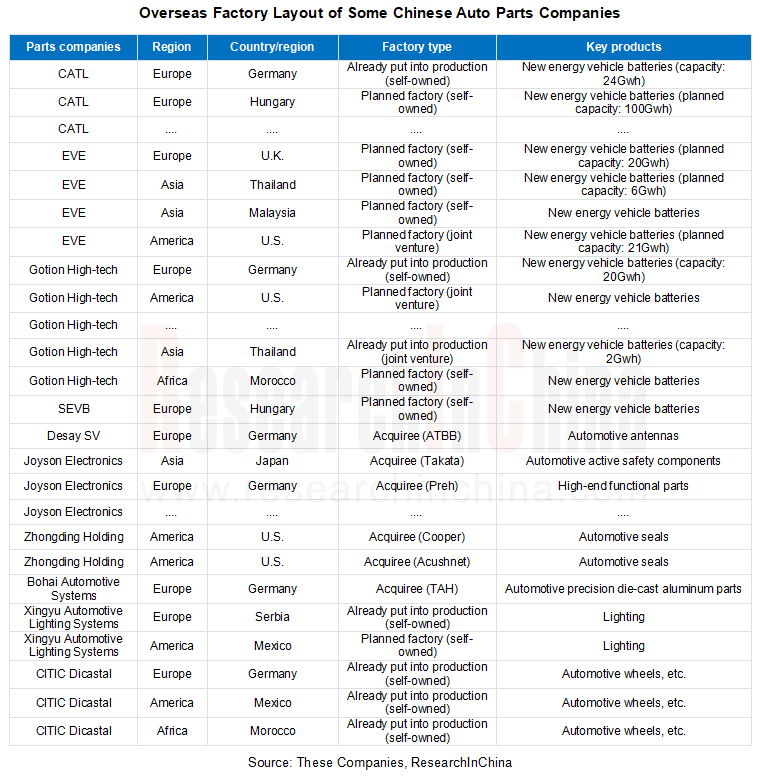

Global Expansion of Supply Chain Companies

Chinese auto parts suppliers are also expanding their presence globally, with a focus on Europe. Companies like CATL, Gotion High-tech, and Joyson Electronics have established manufacturing facilities in Europe to cater to local OEMs.

Traditional auto parts suppliers have pursued overseas acquisitions to strengthen their global footprint. Companies like Desay SV, Joyson Electronics, and Zhongding Holding have acquired European companies to enhance their market reach.

Chinese battery companies are ramping up efforts to build factories in Europe, particularly in Hungary, to meet the growing demand for power batteries in the region.

Intelligent driving solution providers like Pony.ai, iMotion, and WeRide are also expanding into overseas markets by setting up R&D centers and launching projects in various countries.

Overall, Chinese automotive industry players are strategically positioning themselves in key global markets, leveraging their technological prowess and competitive advantages to drive sustainable growth and innovation in the ever-evolving automotive landscape.