House republicans recently passed a tax bill that could have detrimental effects on American households. Not only does the bill promise to channel money from the middle class to billionaires and send jobs to China, but it also threatens to increase electricity costs and hinder the growth of solar installations in the US.

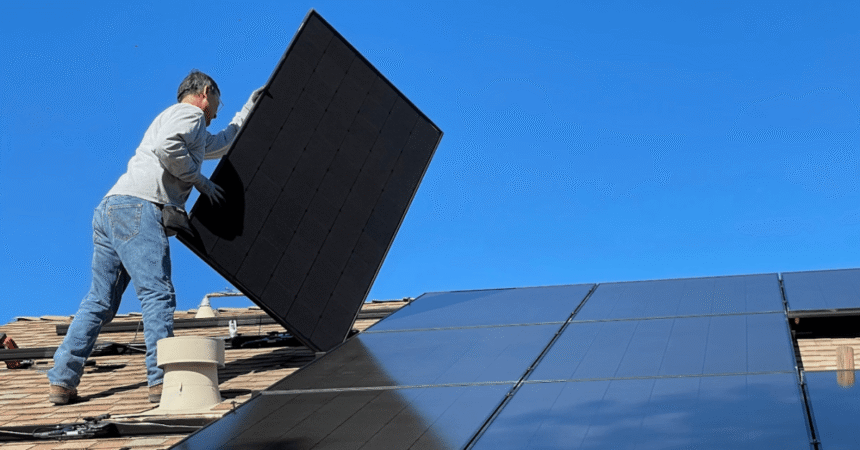

One of the major impacts of the tax bill is the elimination of popular solar credits, such as the 30% residential solar tax credit. This credit has been instrumental in helping homeowners save money on their electricity bills and overall electricity costs. If the bill passes the Senate, the residential credit will sunset at the end of this year, potentially leading to higher electricity bills for Americans.

The Clean Energy Buyers Association released a report showing that repealing solar credits could increase the average American’s electricity bill by 7% by 2026, equivalent to a $110 yearly increase. This could also result in businesses passing on higher costs to consumers in the form of higher prices for consumer goods.

The solar credits have been driving a boom in US energy installations, with 98% of new electrical generation capacity coming from wind and solar in the first months of this year. This is crucial as industries like AI and electric cars are rapidly scaling up and requiring more electricity.

Electric cars are more energy-efficient than gas cars but require a shift towards electrical distribution for energy delivery. AI, on the other hand, consumes significant amounts of energy, contributing to global shortages and increased rates of electricity. Many data centers in the US are turning to green energy sources like solar to offset their energy consumption.

By cutting solar installations, the US could be ceding ground to China in industries like EVs and AI. China has been rapidly transforming its car industry and advancing its AI tech, making it more competitive on the global stage.

The tax bill will now move to the Senate, where changes could be made to address the negative impacts on Americans and US competitiveness. It is important for citizens to voice their concerns to their Senators and urge them to oppose the anti-solar measures in the bill.

In conclusion, the tax bill’s potential impact on solar installations could have far-reaching consequences for American households and the country’s competitiveness in key industries. It is crucial for the Senate to consider the implications of the bill and make necessary modifications to protect the interests of the American people.