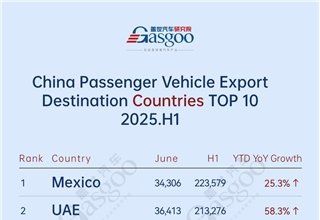

In the first half of 2025, China’s passenger vehicle exports underwent a significant transformation with a noticeable shift towards dominance in new energy vehicles. This shift was accompanied by a divergence in performance across different regional markets. Mexico emerged as the top export destination, surpassing Russia, with a 25.3% year-on-year increase in shipments to 224,000 units. Other markets such as the UAE, Kazakhstan, and Malaysia also experienced notable growth, while Russia and Brazil faced declines due to stricter policy measures.

According to data from the Gasgoo Automotive Research Institute, the long-term outlook for China’s passenger vehicle exports points towards deepening economic and trade ties with Europe and ASEAN regions. This trend, combined with the development of regional production hubs, is expected to drive growth in Europe and Southeast Asia, making them key markets for Chinese exports. The export growth model for Chinese automakers has shifted towards “structural breakthroughs,” with a focus on technology choices and risk diversification as crucial factors for success.

Top 10 destination countries for China’s passenger vehicle exports in the first half of 2025 include Mexico, the UAE, Russia, Brazil, Belgium, the UK, Saudi Arabia, Australia, Kazakhstan, and Malaysia. Mexico led the pack with 224,000 units shipped, driven by efforts from brands like BYD to localize their offerings and expand their market presence.

The Middle East market also witnessed significant growth, with the UAE and Saudi Arabia recording impressive numbers in H1 2025. Chinese automakers like BYD, XPENG, and Zeekr made strides in the region, capitalizing on the growing demand for electrified vehicles. Russia, on the other hand, saw a sharp decline in exports due to policy challenges and consumer concerns over product quality.

In Europe, markets like Belgium and the UK remained battlegrounds for electric vehicles, while Southeast Asian countries like Malaysia leveraged localized production to drive market penetration. Kazakhstan emerged as a dark horse with a surge in exports, highlighting its potential as a key market for Chinese automakers.

The NEV export rankings showed steady growth in mature European markets like Belgium and the UK, while markets in Latin America and the Middle East benefitted from policy incentives. However, Brazil saw a decline in exports due to higher import tariffs, while Southeast Asian markets like Indonesia and Thailand showed structural growth driven by tax incentives and localization efforts.

Looking ahead, Chinese automakers need to navigate challenges like the EU’s carbon border tax and trade policy volatility in key markets. Localization of supply chains and compliance with ESG standards will be crucial for long-term success. Leveraging policy opportunities in emerging markets will also be essential for enhancing brand value and shifting towards sustainable growth in the global automotive market.