The US government recently made a significant decision to block the proposed US$14bn takeover of US Steel Corporation by Japan’s Nippon Steel Corporation. This move came just weeks before the transition to a new government under President-elect Donald Trump. President Joe Biden fulfilled his promise, made during his re-election campaign, to prevent the acquisition of US Steel by a foreign entity, emphasizing the importance of major US companies leading the fight for America’s national interests.

Nippon Steel has expressed its intention to file a lawsuit against the US government in response to the decision. The company claimed that blocking the deal was a clear violation of due process and the law, allegedly serving Joe Biden’s political agenda. Nippon Steel stated that they are left with no choice but to take legal action to protect their rights.

The decision to block the deal was announced after the Committee on Foreign Investment in the US (CFIUS), chaired by Treasury Secretary Janet Yellen, failed to reach a consensus on the potential national security risks associated with the acquisition. Reports indicated that some federal agencies on the panel had concerns about the national security implications.

In response to the decision, Nippon Steel expressed disappointment and concern, stating that the blockage of the deal could strain relations between the US and one of its key allies in Asia. Nippon Steel also highlighted that the decision could deter companies from allied countries from making significant investments in the United States, sending a chilling message to potential investors.

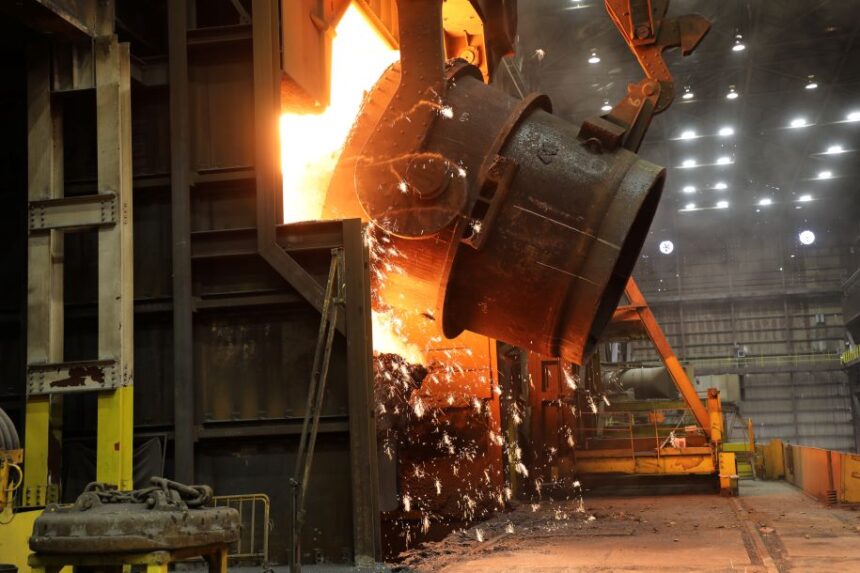

This development underscores the complexities and sensitivities surrounding foreign acquisitions of major US companies, especially in strategic industries like steel production. The aftermath of this decision and the legal battle between Nippon Steel and the US government will likely have implications for future foreign investments in the US market.