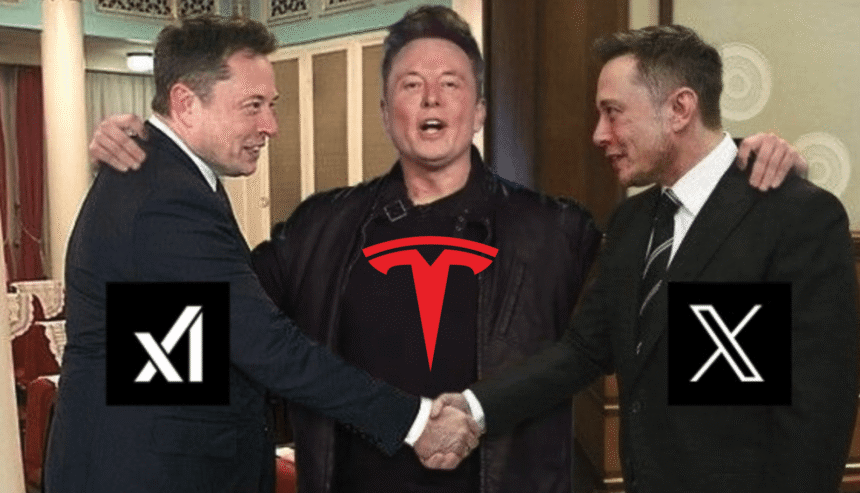

Tesla shareholders will soon have the opportunity to vote on whether to invest in xAI, Elon Musk’s private company. This decision comes after Musk announced his intention to seek greater collaboration between three of his companies: Tesla, xAI, and Twitter.

Musk, known for his involvement in multiple companies, has been integrating resources and technologies across his ventures. This includes incorporating SpaceX technology into Tesla vehicles and implementing xAI’s “Grok” feature into Tesla cars.

In recent years, Musk made headlines for controversial business decisions, such as purchasing Twitter in an all-stock deal valuing the company at $45 billion through xAI. This move was seen as a bailout for Twitter, following Musk’s previous purchase of the social media platform for $44 billion in 2022.

Now, Musk is looking to bring Tesla into the mix by proposing an investment in xAI. However, the decision is not straightforward due to the differences in ownership structures between Tesla and xAI. While Tesla is a public company with multiple shareholders, xAI is a private company solely owned by Musk.

Musk has faced criticism for leveraging Tesla’s resources for the benefit of his private ventures, such as redirecting valuable GPUs from Tesla to xAI and poaching talent from the electric car company for his AI company.

The upcoming shareholder vote on the investment in xAI will take place at Tesla’s annual meeting, which has been delayed to November this year. This delay gives Musk more time to campaign for the investment proposal, which may involve exchanging Tesla shares for a stake in xAI.

Given Musk’s track record of controversial decisions and successful shareholder votes in the past, the outcome of this vote remains uncertain. However, Musk’s determination to increase his ownership stake in Tesla suggests that he will push for the investment in xAI despite potential challenges.

In conclusion, the upcoming decision for Tesla shareholders to vote on investing in xAI reflects Musk’s desire to further integrate his companies and capitalize on synergies between them. The outcome of this vote will have significant implications for the future direction of Tesla and its relationship with Musk’s other ventures.