Tesla’s Robotaxi Services Set to Launch in the San Francisco Bay Area

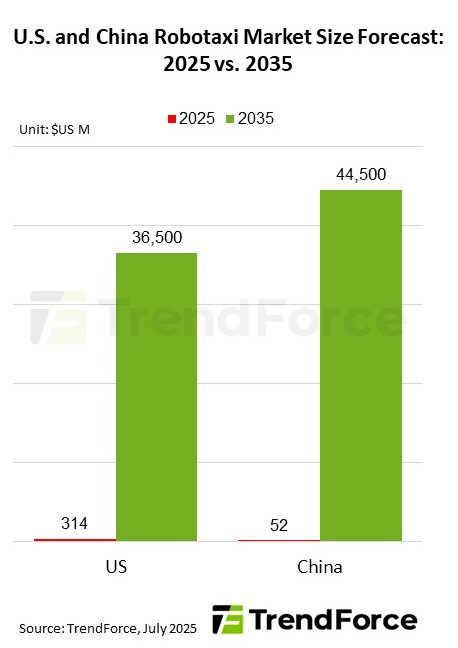

Tesla is currently in the process of testing its Robotaxis in Texas and is gearing up to expand its services to the San Francisco Bay Area. This move has captured the attention of industry experts, with TrendForce predicting that the U.S. Robotaxi market will be dominated by Tesla and Waymo, reaching a market size of US$36.5 billion by 2035. In parallel, China’s Robotaxi sector is also experiencing rapid growth, fueled by a well-established supply chain that is driving down hardware costs.

Last week, Tesla’s CEO Elon Musk revealed that the company is awaiting regulatory approval from California and could potentially launch Robotaxi services in the Bay Area within the next one to two months. TrendForce highlights that California’s autonomous vehicle permits are categorized into testing with a driver, driverless testing, and deployment. Currently, only three companies, including Waymo, hold deployment permits that allow them to offer commercial services to the public in specific areas.

TrendForce points out that Tesla’s Robotaxi rollout hinges on two critical factors. Firstly, the speed at which it can secure a deployment permit by meeting stringent regulatory conditions. Secondly, the company’s ability to commence mass production of the purpose-built Cybercab by 2026, which will directly impact Tesla’s scalability of autonomous driving services and cost efficiency.

TrendForce projects that the U.S. Robotaxi market will witness a robust growth rate of 61% between 2025 and 2035. Tesla’s competitive advantage lies in its vertically integrated manufacturing and vision-based autonomous driving solution, leading to lower hardware costs. While Waymo enjoys a first-mover advantage, it faces the risk of losing market leadership if it fails to scale rapidly and reduce costs effectively.

In China, another major Robotaxi market, TrendForce forecasts a market size of US$44.5 billion by 2035, with a staggering CAGR of 96% from 2025 to 2035. Key players in China include Baidu, Pony.ai, and WeRide, all of which are aggressively expanding their presence. With rapid fleet growth and strong support from domestic EV markets and supply chains, the hardware costs of Robotaxi vehicles and autonomous driving systems in China are expected to witness a significant decline. This, coupled with decreasing per-kilometer ride costs, is likely to drive up user adoption rates.

Despite the immense potential of the Robotaxi market, several challenges lie ahead. Regulatory variations across countries and regions could impede fleet expansion, the complexity of autonomous driving technology and the need for extensive R&D may deter new entrants, while long investment cycles and uncertain profitability timelines add to the complexity of business operations. Moreover, social concerns such as job displacement, operational safety, and data privacy are hurdles that need to be addressed for mainstream adoption and sustained growth.