The first week of 2025 in China saw a decline in the EV market due to disruptions caused by the New Year celebrations. Major EV manufacturers like Nio, Xiaomi, Tesla, and BYD all reported decreases in registrations compared to the previous week. Nio saw a 54% decrease, Xiaomi 31%, Tesla 70%, and BYD 50%.

In 2024, cumulative registrations in China for these manufacturers were as follows: Nio 205,300 EVs, Xiaomi 136,800, Tesla 659,400, and BYD a staggering 3,492,900 units.

Week 1 of 2025 (W1) was compared to the same week in 2024 for a year-on-year analysis. The data on weekly sales is provided by Li Auto and is based on insurance registration data, which includes various types of new energy vehicles (NEVs) such as BEVs, PHEVs, and EREVs.

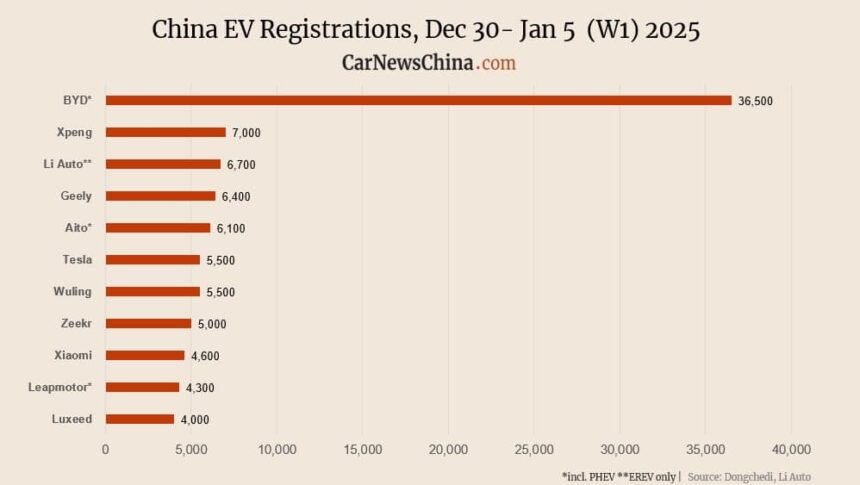

BYD led the market with 36,500 insurance registrations in China, despite a 49.4% decrease from the previous week. Globally, BYD sold 4,250,370 passenger vehicles in 2024, marking a significant increase from the previous year.

Volkswagen-backed Xpeng registered 7,000 vehicles, reflecting a 30.7% decline from the previous week but a 400.0% growth year-over-year. Li Auto recorded 6,700 registrations, down 50.0% from the previous week but up 55.8% from the same period last year. Geely achieved 6,400 registrations, a 38.5% decline from the previous week.

Other notable registrations include Huawei’s Aito with 6,100 units, Tesla with 5,500 units, Wuling with 5,500 units, Zeekr with 5,000 units, Xiaomi with 4,600 units, Leapmotor with 4,300 units, Luxeed with 4,000 units, and Deepal with 3,600 units.

Nio recorded 3,000 registrations, while its brand Onvo registered 2,300 vehicles. BYD’s brand Denza achieved 2,800 registrations, marking a 75.0% increase from the same week last year.

Overall, the EV market in China faced a slowdown in the first week of 2025, but manufacturers are optimistic about the future as they continue to innovate and expand their offerings globally.