In December, China’s power battery installations reached 75.4 GWh, showing a 57.3 percent increase compared to the previous year and a 12.2 percent increase from November, according to data released by the China Automotive Battery Innovation Alliance (CABIA).

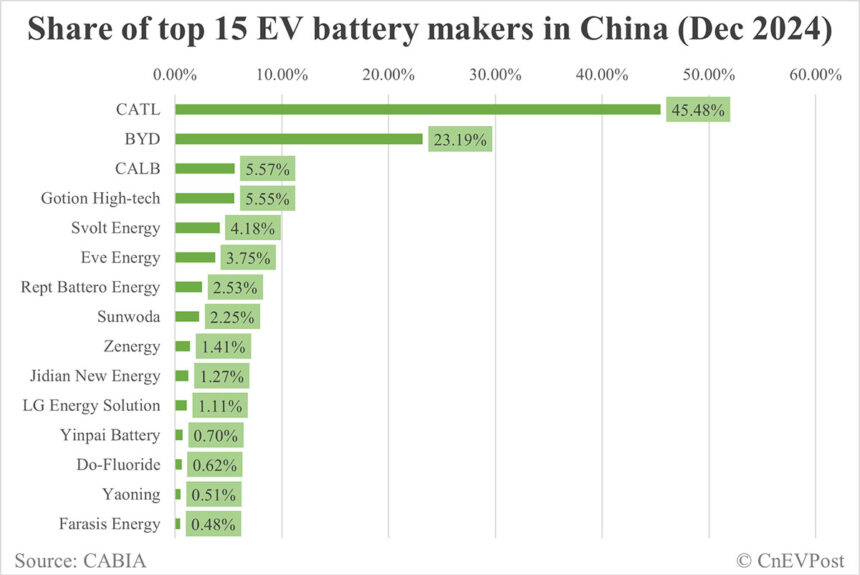

CATL maintained its leading position in December with a power battery installed capacity of 34.29 GWh, representing a 45.48 percent share. BYD followed in second place with 17.49 GWh and a 23.19 percent share, while CALB ranked third with 4.2 GWh and a 5.57 percent share. Gotion High-tech secured the fourth spot with 4.19 GWh and a 5.55 percent share.

The lithium ternary battery installed capacity in December accounted for 19 percent of the total at 14.3 GWh. This marked a 13.4 percent decrease year-on-year but a 5.5 percent increase from November.

Lithium iron phosphate (LFP) batteries dominated the market with installations reaching 61 GWh in December, representing 80.9 percent of the total. This showed a significant 95.1 percent year-on-year increase and a 14 percent increase from November.

In terms of installed capacity for ternary batteries, CATL, CALB, and LG Energy Solution were the top three players in December, holding shares of 67.98 percent, 10.88 percent, and 5.84 percent, respectively.

CATL, BYD, and Gotion led the LFP battery market in December, with shares of 40.21 percent, 28.64 percent, and 6.38 percent, respectively.

China’s overall production of power batteries and other batteries in December reached 124.5 GWh, marking a 60.2 percent increase year-on-year and a 5.7 percent increase from November.

The production of ternary batteries in December was 26 GWh, showing a 4.1 percent increase year-on-year and a 7.2 percent increase from November. LFP battery production in December totaled 98.1 GWh, reflecting an 87.1 percent year-on-year increase and a 5.1 percent increase from November.

China exported 12.9 GWh of power batteries in December, including 7.7 GWh of ternary batteries and 5 GWh of LFP batteries.

For the full year of 2024, China’s total installed capacity of power batteries reached 548.4 GWh, showing a 41.5 percent increase year-on-year. Ternary batteries accounted for 25.3 percent of the total installed capacity at 139.0 GWh, with a 10.2 percent year-on-year growth. LFP batteries accounted for 74.6 percent of the total at 409.0 GWh, marking a 56.7 percent year-on-year increase.

CATL, BYD, and CALB maintained their positions as the top three players in China’s power battery installed capacity in 2024, with CATL leading at 246.01 GWh and a 45.08 percent share, followed by BYD at 135.02 GWh and a 24.74 percent share, and CALB at 36.48 GWh and a 6.68 percent share.

Overall, the power battery market in China continues to show growth and competition among key players, with CATL maintaining its dominant position in the industry.