CATL, a Chinese battery maker, is gearing up to file for a listing on the Hong Kong stock exchange this week, aiming to raise at least $5 billion, as reported by Reuters. The filing is expected to take place on either 11th or 12th February, according to sources familiar with the matter.

Last month, it was revealed that CATL is set to engage JPMorgan Chase & Co., Bank of America, China International Capital Corp, and CSC Financial Co. to facilitate the Hong Kong listing. This move comes amidst heightened geopolitical tensions, with the US recently adding CATL and other Chinese tech firms to a list alleging collaboration with China’s military.

When contacted for a comment, CATL did not immediately respond to Reuters’ inquiry. In January, CATL partnered with China’s SAIC Motor to advance the development of electric vehicle (EV) batteries. The collaboration includes new technology development, battery aftermarket services, and international growth initiatives.

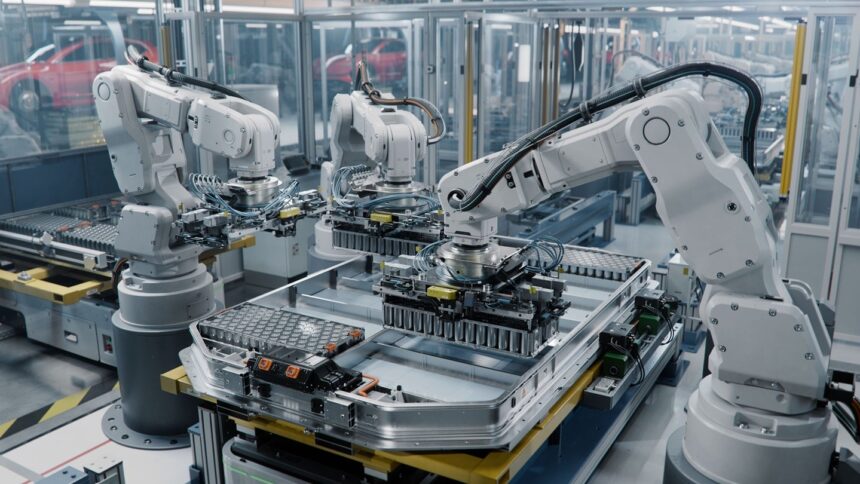

Under the agreement, SAIC Motor has designated CATL as its preferred battery supplier, with CATL’s Qilin and Shenxing batteries given priority for use in SAIC’s EVs. The two companies will also explore battery-swapping technologies, expand charging infrastructures, and delve into battery recycling and repurposing, as well as the pre-owned car market.

In a separate development, CATL announced plans to build 1,000 additional battery swapping stations in 2025 to address concerns over the availability of battery electric vehicle (BEV) charging facilities in China. This move underscores CATL’s commitment to advancing EV technology and infrastructure in the region.