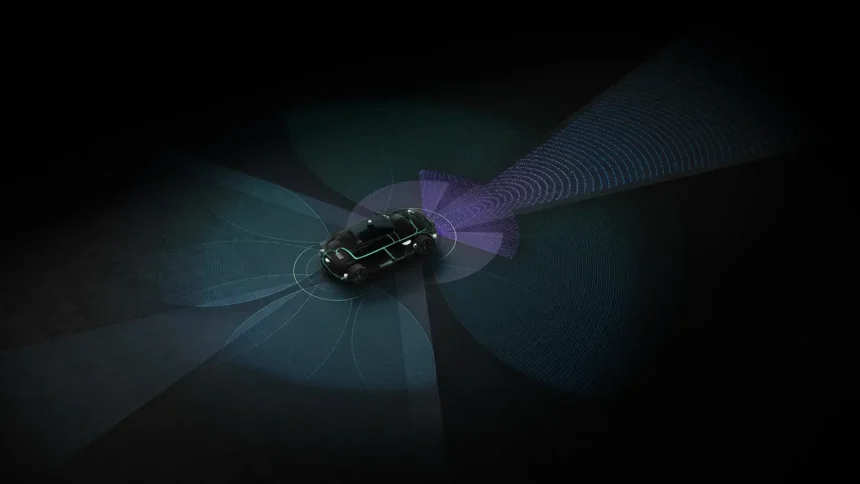

With the advancement of technology, the demand for high-level intelligent driving systems, such as urban NOA, is increasing. This requires the perception system to have a longer detection range, wider detection angle, and higher accuracy. Radars play a crucial role in the perception system, especially 4D imaging radars, which can enhance the overall capability of autonomous driving systems.

4D radar, which provides information on distance, speed, horizontal azimuth, and vertical height, is becoming increasingly popular in the automotive industry. By increasing the number of transmitting and receiving channels, 4D radar offers high accuracy in point cloud imaging, making it a preferred choice over traditional radars. It can even partially replace LiDAR in multi-radar networking scenarios.

In China, the installation of radars in passenger cars is on the rise. According to ResearchInChina, the radar market in China was valued at over RMB6 billion in 2024, with domestic suppliers gaining market share. Front radars are the most popular, accounting for 60% of the market, followed by rear corner radars and front corner radars. Bosch, Continental, and Denso are the top three front radar suppliers, but domestic suppliers like Sensortech, Cheng Tech, and Huawei are increasing their market share.

Domestic radar suppliers are making significant strides in the industry. Companies like sinPro, Chuhang Tech, and Cheng Tech have ramped up their production capacity for 4D imaging radars to meet the growing demand. Technology advancements, cost reduction efforts, and increased competition have led OEMs to diversify their radar suppliers, giving domestic players a chance to enter the supply chain of leading automakers.

The development of radar technology is moving towards more cost-effective solutions. Antenna efficiency is being improved with waveguide antenna technology, and packaging technology is evolving to reduce energy loss. Signal anti-interference measures are being implemented to enhance radar performance in complex environments. The signal processing architecture is shifting towards satellite architecture, allowing for more efficient data processing and object recognition tasks.

While satellite radars offer advantages in computing power and signal processing, they also face challenges such as increased hardware costs and compatibility issues with radar algorithms. OEMs are still adapting to the use of satellite radars and more real-world applications are needed to drive market acceptance.

In conclusion, the mass production of 4D imaging radars is accelerating, and domestic suppliers in China are gaining momentum in the radar market. With technology advancements and increased competition, the automotive industry is set to witness further innovations in radar technology.