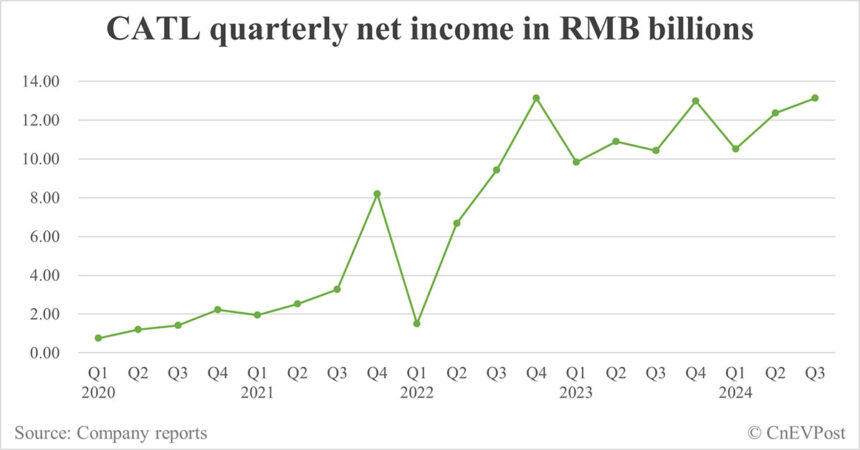

Contemporary Amperex Technology Co Ltd (CATL) recently released its financial results for the third quarter, showing impressive growth despite a slight decrease in revenue compared to the previous year. The company reported a net income of RMB 13.14 billion, marking a 6.32 percent increase from the second quarter. CATL also achieved a record gross margin of 31.17 percent during this period.

CATL’s revenue for the third quarter stood at RMB 92.28 billion, reflecting a 12.48 percent decline year-on-year but a 6.07 percent increase from the second quarter. One of the key factors contributing to the company’s strong financial performance was its effective cost control measures. Operating costs decreased to RMB 63.52 billion, down 22.34 percent from the previous year and 0.48 percent from the second quarter.

The improved cost management strategies directly impacted CATL’s net income, which experienced a significant 25.97 percent year-on-year increase in the third quarter. This net income of RMB 13.14 billion is the second-highest on record, surpassed only by the fourth quarter of 2022. Additionally, CATL achieved a record gross margin of 31.17 percent, surpassing 30 percent for the first time.

In terms of operational performance, CATL installed 64.39 GWh of power batteries in the third quarter, marking a 48.81 percent increase from the same period last year and a 23.85 percent increase from the second quarter. Despite a 12.09 percent year-on-year decline in revenue for the first three quarters, the company’s net income rose by 15.59 percent compared to the previous year.

In China, CATL maintained its leading position in power battery installations, accounting for a 44.02 percent share in September. Globally, the company installed 189.2 GWh of EV batteries from January to August, securing a market share of 37.1 percent, the highest among all battery suppliers.

CATL’s continuous innovation and strong financial performance underscore its position as a key player in the electric vehicle battery industry. With a focus on cost control, operational efficiency, and market leadership, CATL is poised for further growth and success in the evolving EV market.