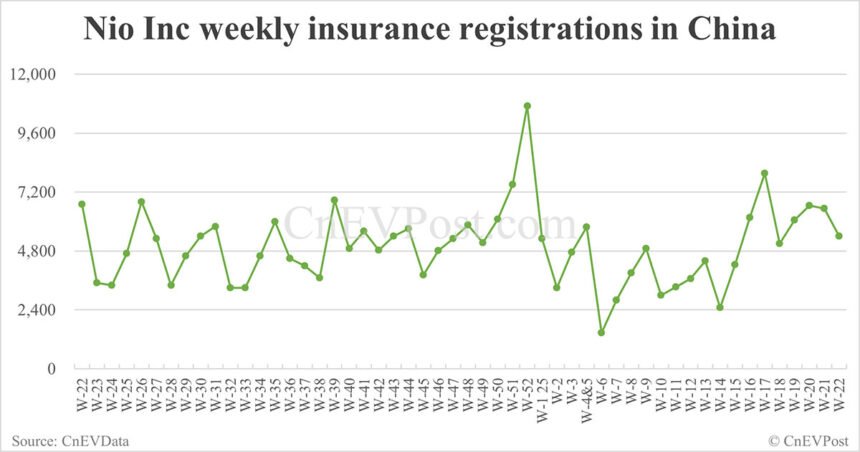

Electric vehicle (EV) makers in China experienced mixed results in insurance registrations during the final week of May. Nio Inc, which includes the Nio, Onvo, and Firefly brands, saw a total of 5,400 insurance registrations last week, marking a 17.30 percent decrease from the previous week.

Specifically, the Nio brand vehicles recorded 3,000 insurance registrations, a drop of 21.88 percent from the previous week. Onvo, a sub-brand of Nio, saw 1,400 insurance registrations, down by 10.26 percent, while Firefly, another sub-brand, had 1,000 registrations, showing an 11.50 percent decrease.

Nio Inc also delivered 23,231 vehicles in May, with the main Nio brand delivering 13,270 units, Onvo delivering 6,281 units, and Firefly delivering 3,680 units. The company expects to deliver between 72,000 and 75,000 vehicles in the second quarter of 2025.

On the other hand, Tesla saw an 18.18 percent increase in insurance registrations in China last week, with 13,000 vehicles registered compared to 11,000 the previous week. The US EV maker’s Shanghai factory produces the Model 3 sedan and Model Y crossover, catering to domestic and export markets.

Xpeng, another prominent EV maker, reported 7,300 insurance registrations last week, marking a 28.07 percent increase from the previous week. The company delivered 33,525 vehicles in May, continuing its streak of monthly deliveries exceeding 30,000 units.

Li Auto experienced a 14.29 percent increase in insurance registrations last week, with 12,000 units registered. The company delivered 40,856 vehicles in May, showing a 16.66 percent increase from the same period last year.

BYD, with 59,800 insurance registrations last week, saw a 12.20 percent increase from the previous week. The company sold 382,476 vehicles in May, up 15.27 percent year-on-year.

Xiaomi, with 7,800 insurance registrations last week, marked a 14.71 percent increase from the previous week. The company’s EV unit delivered over 28,000 units in May, aiming for profitability in the second half of 2025.

Other notable EV makers like Zeekr, Leapmotor, Aito, and Xiaomi EV also saw increases in insurance registrations and deliveries in May. The EV market in China continues to show dynamic growth and competition among key players.