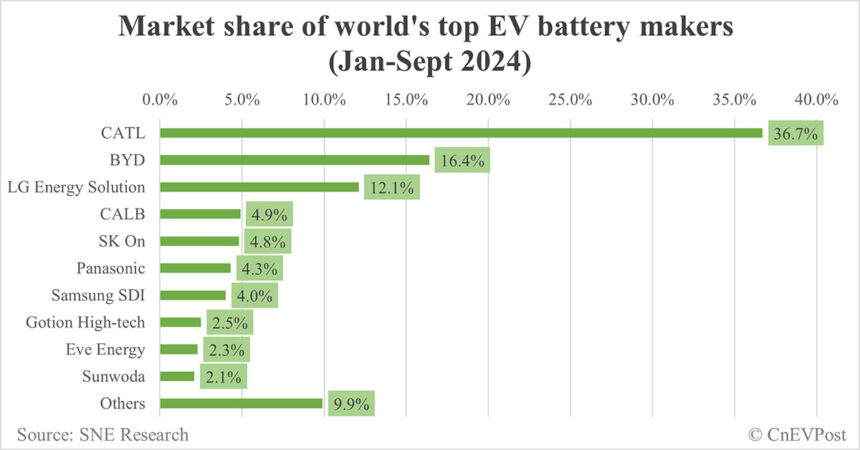

CATL and BYD have maintained their positions as the top two battery makers globally in the January-September period, with CATL experiencing a slight decrease in share while BYD’s share remained unchanged.

According to data from South Korean market researcher SNE Research, global electric vehicle (EV) battery usage reached 599.0 GWh in the January-September period, a 23.4 percent increase from the previous year’s 485.3 GWh.

CATL’s EV battery installations during this period totaled 219.6 GWh, a 26.5 percent increase from the same period last year. The Chinese company continues to lead the market with a 36.7 percent share, the only supplier with a market share exceeding 30 percent. Although CATL’s share was higher than the previous year’s 35.8 percent, it was slightly lower than the 37.1 percent share in the January-August 2024 period.

On the other hand, BYD’s power battery installations reached 98.5 GWh in January-September, a 28.0 percent increase from the previous year. The company held onto its second position with a 16.4 percent share, up from 15.9 percent in the same period last year.

BYD’s success can be attributed to its strong sales performance in the new energy vehicle (NEV) segment. The company achieved record-breaking sales figures, selling 419,426 NEVs in September and 502,657 NEVs in October, the first time surpassing 500,000 units in a single month.

While BYD briefly fell behind LG Energy Solution in EV battery share early in the year, it quickly regained ground due to the strong performance of its NEV sales.

LG Energy Solution, with power battery installations of 72.4 GWh in the January-September period, held the third position with a 12.1 percent share. Other notable players in the market included CALB from China (4.9 percent), SK On from South Korea (4.8 percent), and Panasonic from Japan (4.3 percent).

Rounding out the top ten were Samsung SDI from South Korea (4.0 percent), Gotion High-tech from China (2.5 percent), Eve Energy from China (2.3 percent), and Sunwoda from China (2.1 percent) in the January-September period.

Overall, CATL and BYD’s continued dominance in the global battery market highlights their strong positions in the industry, driven by innovative technologies and robust sales performance in the EV sector.