Li Auto, a Chinese automaker listed on NASDAQ as LI, recently announced its third-quarter financial results, showcasing record revenue of RMB 42.9 billion. This figure surpassed analysts’ expectations and was driven by a surge in vehicle deliveries.

The company reported a substantial increase in revenue from vehicle sales, reaching RMB 41.3 billion in the third quarter. This was an impressive 22.9 percent jump from the same period last year and a 36.3 percent increase from the previous quarter. The growth in revenue was primarily attributed to higher vehicle deliveries, despite a slight decrease in the average selling price due to product mix variations.

Li Auto achieved a record 152,831 deliveries in the third quarter, falling within its guidance range of 145,000 to 155,000 units. This marked a 45.4 percent year-on-year increase and a 40.75 percent rise from the second quarter.

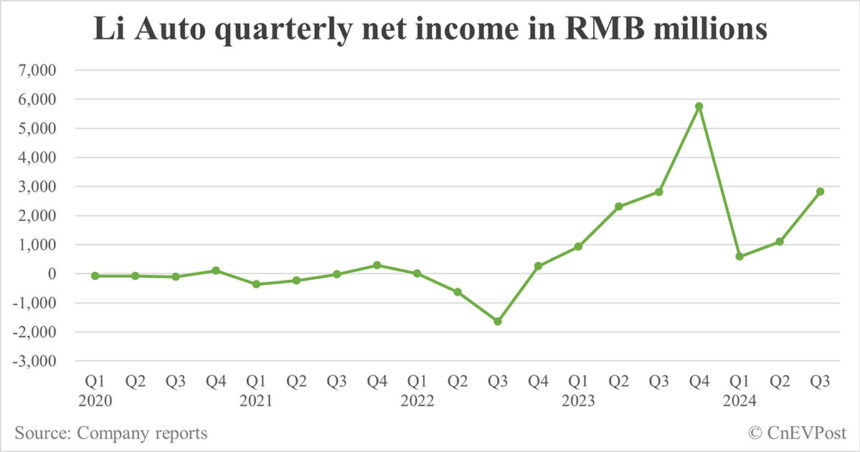

Net income for the third quarter stood at RMB 2.82 billion, surpassing analysts’ expectations. Non-GAAP net income was reported at RMB 3.9 billion, reflecting a robust 11.1 percent increase from the same period last year. The company’s gross margin for the quarter was 21.5 percent, with a vehicle margin of 20.9 percent.

R&D expenses decreased to RMB 2.6 billion in the third quarter, mainly due to lower design and development costs for new products and technologies. Li Auto’s cash position also improved, reaching RMB 106.5 billion as of September 30.

Looking ahead, Li Auto projected fourth-quarter vehicle deliveries to be in the range of 160,000 to 170,000 units, with revenue expected to range between 43.2 billion yuan and 45.9 billion yuan. This guidance implies a year-on-year growth of 3.5 percent to 10.0 percent.

Despite the positive financial performance, Li Auto’s stock price fell by 5.32 percent to $27.4 in US pre-market trading. The company’s full-year sales target for 2024 was adjusted to between 501,812 and 511,812 units, reflecting a slight decrease from the initial target set by founder and CEO Li Xiang.

Li Auto’s plans for overseas market expansion, particularly targeting the Middle East and Latin America, are also gaining traction. This strategic move could open up new growth opportunities for the company in the global automotive market.

As Li Auto continues to navigate market challenges and pursue expansion initiatives, investors will closely monitor its performance and strategic decisions in the coming quarters.