Power semiconductors, once seen as a promising sector alongside AI chips, are now facing challenges due to a slowdown in the electric vehicle (EV) market. According to reports from ijiwei and Nikkei, major players in the industry are making significant cutbacks in jobs and investments, with layoffs exceeding 8,800.

These power semiconductors play a crucial role in enhancing EV range and improving the efficiency of home appliances, leading to substantial investments from industry giants. However, Renesas, a prominent player in Japan, is planning to reduce its workforce by less than 5%, equating to around 1,050 positions globally. Additionally, the company is delaying mass production at its Kofu plant, originally scheduled for early 2025.

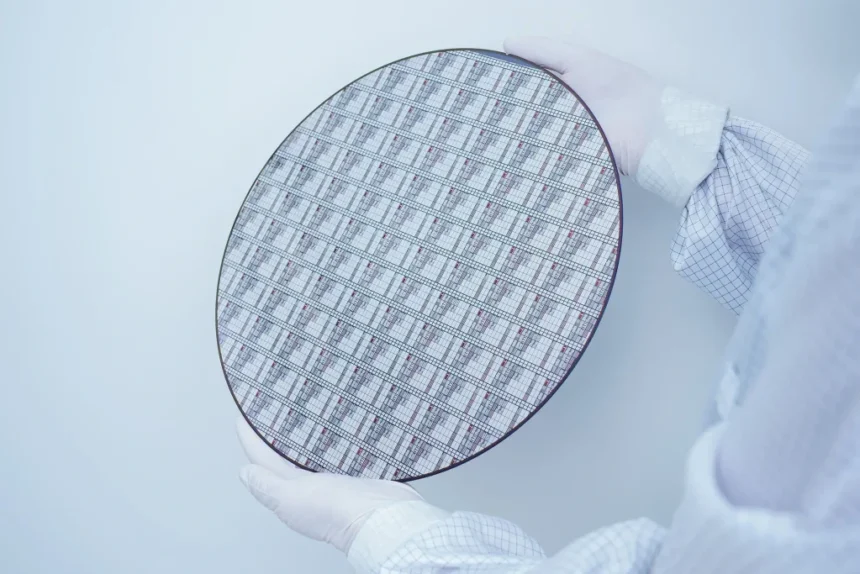

Similarly, Germany’s Infineon, a leading global supplier of power semiconductors, has announced plans to cut 1,400 jobs worldwide and relocate another 1,400 positions to reduce costs. This move comes as the company prepares to open the world’s largest 200mm silicon carbide (SiC) facility in Malaysia in 2024.

STMicroelectronics, another major player based in Europe, also aims to reduce its workforce by up to 3,000 employees, approximately 6% of its total workforce. Onsemi, headquartered in the United States, is restructuring its operations to lower costs, including laying off about 2,400 employees across all divisions in 2025.

The impact of the downturn is also being felt by suppliers in the industry. U.S.-based Wolfspeed is reportedly laying off 1,000 employees, representing 20% of its workforce. The company specializes in producing wide-bandgap semiconductors, focusing on materials like silicon carbide and gallium nitride.

The challenges faced by these power semiconductor giants may be exacerbated by increasing competition from China. Companies like BYD and CanSemi Technology have initiated large-scale production of power semiconductors, posing a threat to established players. With the U.S. imposing restrictions on advanced chipmaking equipment exports to China, manufacturers in the country are seeking alternative sources for equipment, particularly in the power semiconductor sector.

To combat these challenges, Japanese firms are collaborating to mitigate financial pressures amidst sluggish market demand and heightened competition. Companies like Toshiba, Rohm, Fuji Electric, and Denso are pooling resources to invest in production capabilities, with commitments totaling billions of yen.

The power semiconductor industry is navigating through a turbulent period, marked by job cuts, investment delays, and increased competition. As players adapt to these changing dynamics, collaboration and innovation will be key to sustaining growth and competitiveness in the evolving market landscape.