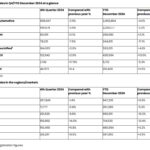

TrendForce’s recent findings suggest that the downward trend in Chinese EV and ESS battery prices in 2024 may be coming to a halt, with suppliers looking to increase prices to offset losses as global demand for EVs and energy storage is expected to rise in 2025. This is projected to stabilize the prices of key battery materials like LFP, li-ion battery copper foil, and electrolytes, ultimately stabilizing average battery cell prices in the first quarter of 2025.

According to TrendForce, while EV battery prices saw an overall decline in 2024, demand during the peak season in the latter half of the year helped slow this downward trend significantly in Q4. Looking forward to 2025, the Chinese EV market is anticipated to see a 30% year-on-year increase in sales, driven by government policies such as vehicle trade-in incentives. This positive demand outlook is expected to help stabilize battery material costs, with January prices for EV batteries likely to remain steady compared to December levels.

In the energy storage market, robust growth in regions like China, the US, and Europe in 2024 has been accompanied by increasing demand in emerging markets such as the Middle East and Southeast Asia. However, challenges like excess production capacity and declining raw material costs have continued to push LFP ESS battery prices lower. Fortunately, this downward trend is starting to slow down.

As the energy storage market enters its off-season in the first quarter of 2025, many battery manufacturers are expected to scale back production. Coupled with relatively stable material costs, ESS battery prices in January are forecasted to remain unchanged.

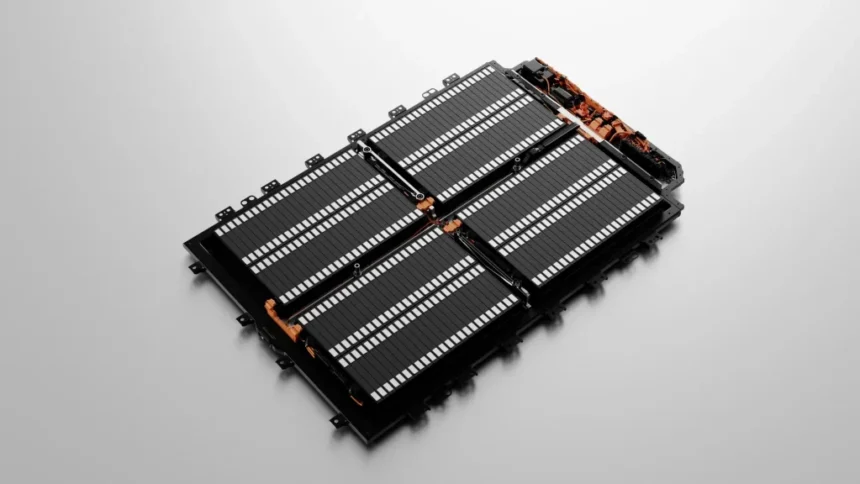

Manufacturers in the ESS battery market are shifting their focus towards advancing technology and improving production processes to stay competitive. Some companies have already introduced ultra-large-capacity storage batteries exceeding 500Ah to raise barriers to entry in the industry. These high-capacity cells are projected to enter the market gradually throughout 2025.

TrendForce notes that the decline in prices for most battery materials has reached a plateau, with limited room for further reduction. Materials like LFP, li-ion battery copper foil, and electrolytes, which have been causing losses for suppliers, experienced slight price rebounds in December 2024. With terminal automakers engaged in fierce price competitions, battery manufacturers are facing increased pressure from rising raw material costs, necessitating greater efforts to control overall production expenses.

Overall, the outlook for EV and ESS battery prices in 2025 is cautiously optimistic, with stabilizing material costs and increasing global demand set to support prices in the coming year. The industry is expected to continue evolving as manufacturers adapt to changing market conditions and technological advancements.