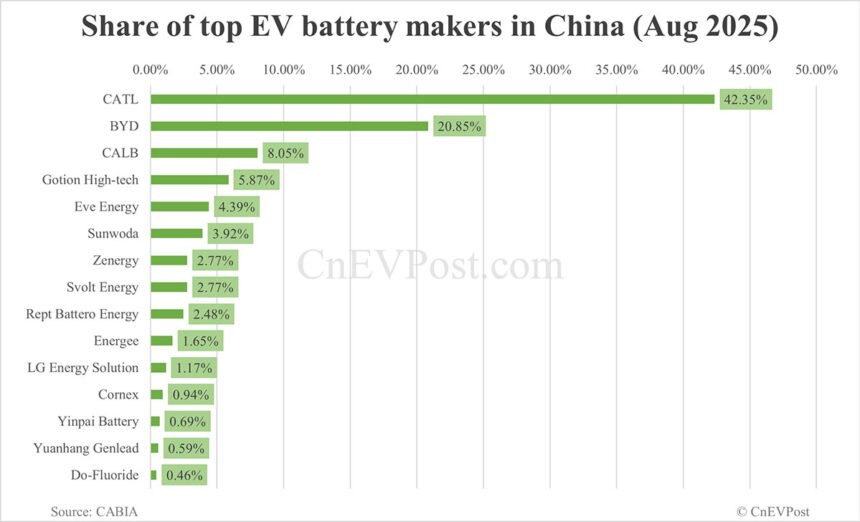

CATL (SHE: 300750) saw a significant increase in its market share in China’s electric vehicle (EV) battery sector in August, while BYD (HKG: 1211, OTCMKTS: BYDDY) experienced a slight decline. According to data released by the China Automotive Battery Innovation Alliance (CABIA), CATL’s share increased by 0.95 percentage points compared to July, reaching a market share of 42.35%. On the other hand, BYD’s share decreased by 0.34 percentage points, with a market share of 20.85% in August.

In total, CATL and BYD collectively accounted for 63.2% of China’s power battery installations in August. The country’s power battery installations totaled 62.5 GWh during the month, representing a 32.4% year-on-year increase and an 11.9% month-on-month rise.

CATL maintained its top position in the market, installing 26.45 GWh of power batteries in August. This marked a 0.95 percentage point increase from its July share. BYD ranked second with 13.02 GWh of battery installations, holding a 20.85% market share, a slight decrease from the previous month.

CALB secured the third spot with 5.03 GWh of battery installations and an 8.05% market share. Gotion High-tech and Eve Energy followed, ranking fourth and fifth with 3.67 GWh and 2.74 GWh of installations, respectively.

In terms of battery types, ternary lithium battery installations totaled 10.9 GWh in August, accounting for 17.5% of total installations. LFP batteries, on the other hand, recorded an installation volume of 51.6 GWh, representing 82.5% of total installations.

CATL, CALB, and Svolt Energy were the top three ternary battery suppliers in August, holding market shares of 72.45%, 10.38%, and 7.15%, respectively. In the LFP battery market, CATL, BYD, and CALB led the installations with shares of 35.98%, 25.27%, and 7.56%, respectively.

Overall, China’s total production of power batteries and other batteries reached 139.6 GWh in August, a 37.3% year-on-year increase. Ternary battery production totaled 30.9 GWh, while LFP battery production reached 108.6 GWh. The country also exported 15.1 GWh of power batteries in August.

The data highlights the continued dominance of CATL and BYD in China’s EV battery market and the ongoing growth and development of the industry in the country.