The Chinese auto market witnessed a surge in price cuts for various models in 2024, with a total of 227 models experiencing reductions. This number is significantly higher than the 148 models in 2023 and the 95 models in 2022, according to a report by Cui Dongshu, the secretary-general of the China Passenger Car Association (CPCA).

The price cuts were predominantly observed in conventional gasoline vehicles and battery electric vehicle (BEV) models, with 88 and 82 models respectively seeing reductions. Additionally, hybrid electric vehicles (HEVs) had 17 models with price cuts, plug-in hybrid electric vehicles (PHEVs) had 34, and extended-range electric vehicles (EREVs) had 14.

On average, the price reductions for all models amounted to RMB 16,000, representing an 8.3 percent decrease. New energy vehicle (NEV) models saw a slightly higher average price cut of RMB 18,000, or 9.2 percent, while conventional gasoline vehicles saw an average reduction of RMB 13,000, or 6.8 percent.

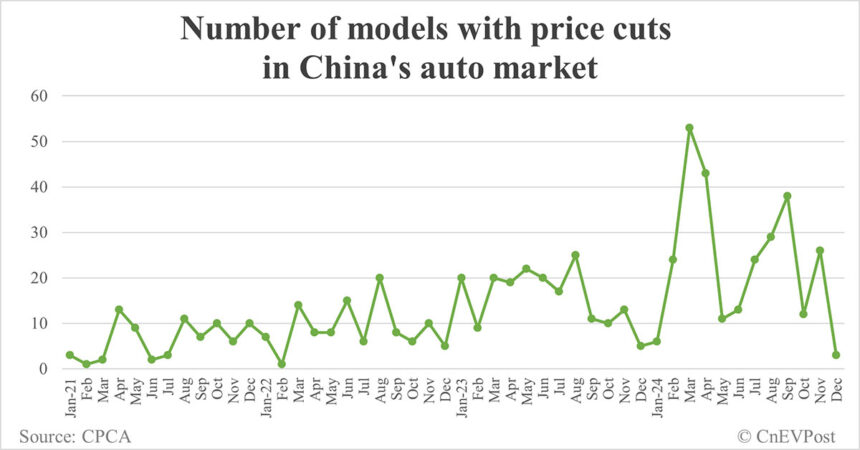

In terms of seasonal trends, the peak months for price cuts in 2024 were March and April, in contrast to the more balanced distribution seen in 2023. The number of models with price reductions was highest in March with 53 models and in April with 43 models. Subsequently, the number of price cuts decreased in May, June, and October, marking a temporary lull in the wave of price reductions.

The report also highlighted that NEV price cuts were concentrated in February-April and July-September, while gasoline vehicles saw reductions in March-April and July, September, and November. In December, it is projected that retail sales of China’s passenger NEVs will reach 1.4 million units, with wholesale sales estimated to be 1.5 million units, both setting new records.

The data indicates a dynamic and competitive landscape in China’s auto market, with manufacturers implementing strategic pricing strategies to attract consumers. Stay tuned for more updates on the latest developments in the automotive industry on CnEVPost.