Chinese Mainland Sees Record High in Domestic Passenger Vehicle Registrations in November 2024

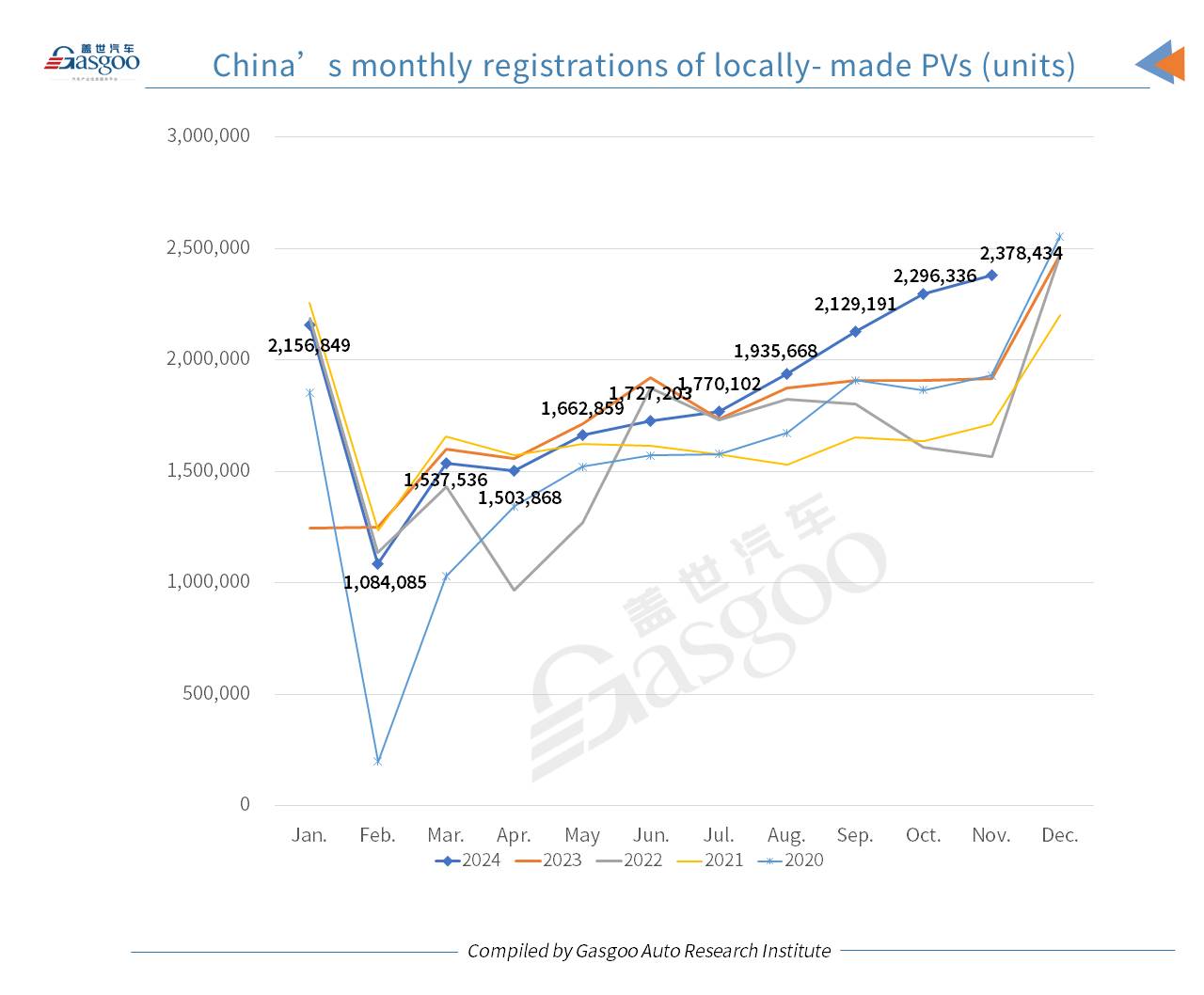

In November 2024, the Chinese Mainland witnessed a significant surge in registration volume for domestically produced passenger vehicles (PVs), reaching 2,378,434 units. This marked a 24.07% year-on-year increase and a 3.58% month-on-month growth, setting a new monthly high for the year, as reported by the Gasgoo Auto Research Institute (“GARI”).

The data revealed that out of the total PVs registered in November, 1,236,123 units were classified as new energy vehicles (NEVs), achieving a penetration rate of 51.97% and setting another record high for monthly registrations.

Market Trends and Drivers

The strong performance in the PV market in November was attributed to the continued positive momentum observed in October. Policies promoting vehicle scrappage and trade-ins played a significant role in stimulating the market and stabilizing vehicle sales. Events like the “Double 11” shopping festival and Auto Guangzhou 2024 also contributed to driving consumer attention and market growth.

The vehicle scrappage and trade-in policies, more effective than previous stimulus measures, have shown immediate impacts on the market. By mid-November, applications for car scrappage and trade-in subsidies had exceeded 2 million, reflecting strong consumer demand for new car purchases.

Shift towards New Energy Vehicles

The national subsidy program offering incentives for NEVs has led to a significant shift in consumer preferences. With subsidies favoring NEVs over traditional vehicles, there has been a notable increase in registrations of battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs), further driving the expansion of the NEV market.

Key Statistics:

- Cumulative PV registrations on the Chinese Mainland in the first eleven months of 2024: 20,182,131 units (8.31% YoY increase)

- Cumulative NEV registrations: 9,458,528 units (48.93% YoY increase)

- Top 20 cities by registrations: Chengdu, Beijing, Shanghai

Top Brands and Models

Leading brands in November included BYD, Volkswagen, and Toyota, with BYD dominating the market. Popular models like the BYD Seagull and Tesla Model Y showcased strong performance.

Top 20 PV models by November registrations:

- BYD Seagull

- Tesla Model Y

- Volkswagen Lavida

Top 20 cities by November NEPV registrations:

- Shanghai

- Hangzhou

- Chengdu

Overall, the PV market in China continues to experience growth, driven by government policies, consumer demand, and advancements in NEV technology.