The Chinese electric vehicle (EV) market experienced significant growth in July 2024, with a total of 887,255 EVs sold, marking a 33% increase compared to the previous year. The majority of this growth was driven by plug-in hybrids (PHEVs), which saw a sales jump of 87% year on year, totaling around 419,000 units. On the other hand, battery-electric vehicles (BEVs) recorded a more modest 6% increase with 468,000 units sold.

EVs accounted for 51.4% of all new-car sales in China in July, with BEVs alone representing 27% of the total market share and 53% of plug-in sales. However, this fell below the average of 58% seen in the first seven months of the year. The popularity of PHEVs in China indicates a shift towards mainstream adoption, appealing to the ‘early majority’ of buyers and showcasing the powertrain’s potential to attract more consumers to electric vehicles.

In the first seven months of 2024, EV sales in China reached almost 5.2 million units, a significant increase from the 3.9 million units sold during the same period in the previous year. With EVs accounting for 45% of all new-car sales between January and July, it is expected that plug-in powertrains will make up around half of the overall new-car market by the end of 2024.

The top-selling cars in China for July were dominated by EVs, with the best-selling internal-combustion engine (ICE) model being the Volkswagen Lavida in eighth place, followed by the Nissan Sylphy in 10th. Both ICE models experienced declines in sales compared to the previous year, highlighting the growing preference for electric vehicles in the market.

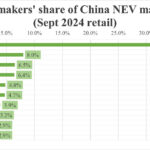

BYD emerged as a key player in the Chinese EV market, with six out of the top seven best-selling EVs belonging to the brand. BYD’s competitive pricing strategy on its electric models has challenged the dominance of ICE vehicles and other EV manufacturers in the market. Plug-in models led across various passenger car segments, with BYD models securing top positions in multiple categories.

The BYD Song emerged as the leader in the Chinese EV market in July, with the midsize SUV recording 52,642 registrations. The model’s success will depend on its ability to compete with other BYD offerings such as the Song L, Sea Lion, and Denza N7. The BYD Qin Plus and the Tesla Model Y also performed well, securing second and third place respectively in the EV sales chart for July.

Overall, BYD models dominated the top positions in the Chinese EV market, with several new potential best-sellers set to enter the market. Despite the risk of cannibalization among existing models, these newcomers are expected to further solidify BYD’s lead and attract customers away from competitors.

In conclusion, the Chinese EV market is experiencing rapid growth, with BYD establishing a strong foothold as a leading player. The popularity of plug-in hybrids and increasing consumer interest in electric vehicles indicate a promising future for the EV market in China.