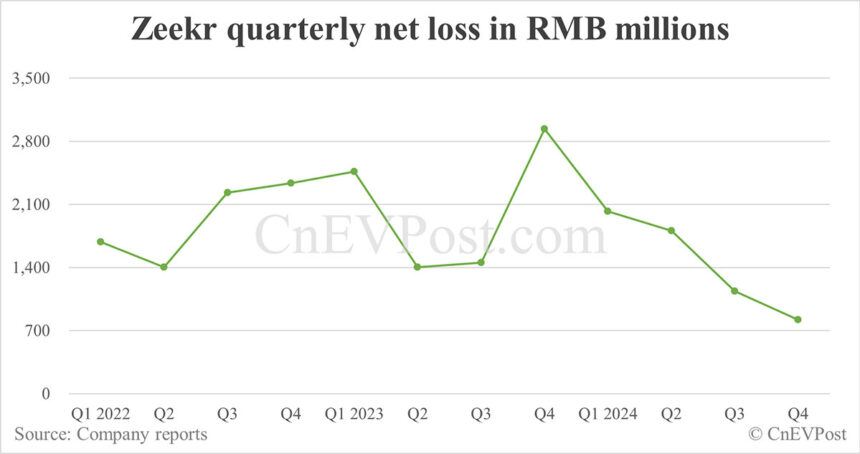

Zeekr, a leading electric vehicle (EV) maker, reported a net loss of RMB 821 million yuan ($112 million) in the fourth quarter of 2024, marking a significant decrease of 72.1 percent year-on-year and a 28.0 percent decrease compared to the previous quarter. Despite the loss, Zeekr achieved a record gross margin of 19.0 percent in the fourth quarter, surpassing its performance in the same period in 2023 and the third quarter of 2024.

The company’s revenue in the fourth quarter reached RMB 22.78 billion yuan ($3.12 billion), representing a robust year-on-year increase of 39.2 percent and a quarter-on-quarter growth of 24.1 percent. Vehicle sales contributed significantly to the revenue, with RMB 19.3 billion yuan generated from vehicle sales alone, marking an 82.2 percent year-on-year increase and a 34.0 percent increase from the previous quarter.

The growth in revenue was primarily attributed to a surge in new product deliveries, although the average selling price was slightly lower due to changes in product mix and pricing strategies. Notably, the delivery of Zeekr 7X vehicles saw a substantial uptick in the fourth quarter, contributing to the overall performance.

Zeekr delivered a total of 79,250 vehicles in the fourth quarter, marking a remarkable 99.84 percent increase from the same period in 2023 and a 44.08 percent increase from the third quarter. This increase in deliveries, coupled with cost reductions and procurement savings, contributed to the company’s improved financial performance.

Despite the net loss, Zeekr’s operating costs increased by 31.6 percent year-on-year in the fourth quarter, primarily driven by higher vehicle deliveries. The company also reported a record gross margin of 19.0 percent, reflecting its cost reduction initiatives and improved operational efficiency.

Furthermore, Zeekr invested RMB 3.21 billion in research and development in the fourth quarter, representing a 1.4 percent year-on-year increase and a significant 63.0 percent increase from the previous quarter. This investment was directed towards developing new products and technologies to enhance its competitive position in the EV market.

Looking ahead, Zeekr did not provide guidance for first-quarter deliveries or revenue. The company recently completed a series of transactions to acquire a 51 percent stake in the sister brand Lynk & Co, signaling its strategic expansion and integration efforts in the EV industry.

In conclusion, Zeekr’s strong performance in the fourth quarter underscores its growing presence in the EV market. Despite facing challenges such as net losses, the company’s focus on innovation, cost management, and strategic partnerships positions it well for future growth and success in the electric vehicle industry.